Worldwide shipments of industrial printers were lower in Q4, according to IDC Tracker.

Worldwide shipments of industrial printers declined 11.6% year over year to 78,500 units in the fourth quarter of 2022 (4Q22), according to results from the International Data Corporation (IDC) Worldwide Quarterly Industrial Printer Tracker. Results for the full year 2022 were also down, with shipments declining 12.9% compared to 2021.

Worldwide shipments of industrial printers declined 11.6% year over year to 78,500 units in the fourth quarter of 2022 (4Q22), according to results from the International Data Corporation (IDC) Worldwide Quarterly Industrial Printer Tracker. Results for the full year 2022 were also down, with shipments declining 12.9% compared to 2021.

“The fourth quarter was soft and concluded a down year for the sector overall,” said Tim Greene, Research Director, Hardcopy Solutions at IDC. “For much of the industrial printing market China is a key manufacturing centre, so while the region is opening up now, for most of 2022 the market in China was slow and limited worldwide growth. 2022 is a prime example of how growth, driven by digital transformation, is not linear and can be disrupted by macro events.”

Q4 2022 Highlights

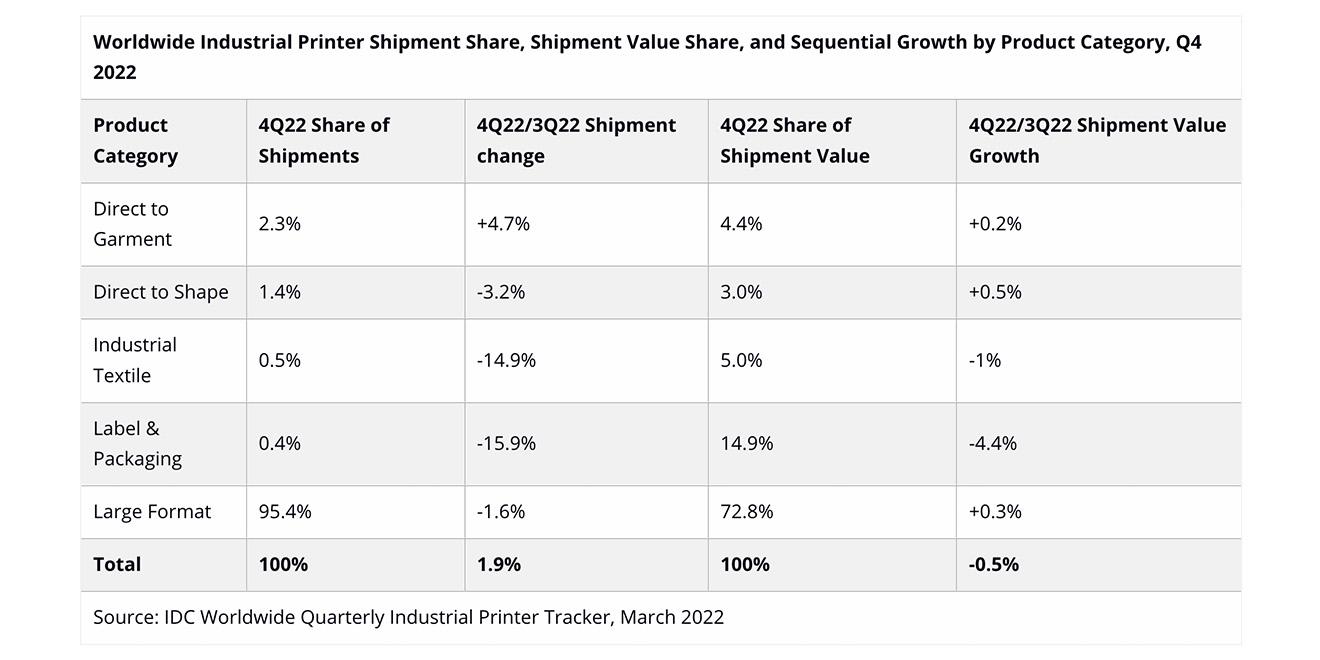

- Large format digital printer shipments declined 1.6% compared to the previous quarter (3Q22) and 11.7% year over year.

- Direct-to-garment (DTG) printer shipments grew 4.7% sequentially and 8.4% year over year in 4Q22.

- Direct-to-shape printer shipments saw a modest decline of 2.2% compared to Q3 2022 and 6.6% year over year.

- Worldwide shipments in the industrial textile segment declined almost 15% sequentially and nearly 50% compared to the full year 2021.

- Industrial digital label & packaging printer shipments declined 15.9% compared to Q3 2022 and 8.9% year over year.

Regional Analysis

- Shipments in the Central & Eastern European and Western European markets were bright spots with double-digit shipment growth for both regions in Q4 2022.

- China saw shipments decline 21% compared to Q3 2022.

- The strongest growth was in the Middle East and Africa region, which saw shipment growth of 36% compared to Q3 2022.

- 4Q22 shipments in North America (US + Canada) were down 6% compared to 3Q22.

2022 Highlights

- Large format digital printer shipments declined 12.9% on a worldwide basis compared to 2021.

- Direct-to-garment (DTG) printer shipments fell 6.8% year over year driven by slower shipments outside of North America.

- Direct-to-shape printer shipments fell 5% compared to 2021 primarily on softness in China and Western Europe.

- The industrial textile printer market, which is heavily influenced by the market in China, saw the steepest decline with shipments down 45% compared to 2021.

- Industrial digital label & packaging printer shipments declined 5.4% year over year in 2022.

Regional Analysis

- Shipments in the Central & Eastern European market were down 35% in 2022 as global vendors limited their activities in the region due to the war in the Ukraine.

- Shipments in China declined by 46% for 2022 compared to 2021.

- Shipments in North America (US + Canada) were effectively flat from 2021 to 2022.

- Shipments in the Middle East and Africa regions grew 25% in 2022 compared to 2021.

- Shipments in the Asia/Pacific region (excluding Japan and China) grew 10% year over year in 2022.

IDC’s Worldwide Quarterly Industrial Printer Tracker provides total market size and vendor share for five major market categories: large format, label & packaging, direct to garment, industrial textile, and direct to shape. In addition to units, shipment value, and ASP, the Tracker also provides market results for each product category by ink type, media size, hardware class, or primary application across nine geographic regions and 90 countries.