New data from International Data Corporation shows that amidst trade tensions between the USA and China, new technologies are driving the worldwide ICT market towards an annual spending figure of $6 trillion (€5.18 trillion).

New data from International Data Corporation shows that amidst trade tensions between the USA and China, new technologies are driving the worldwide ICT market towards an annual spending figure of $6 trillion (€5.18 trillion).

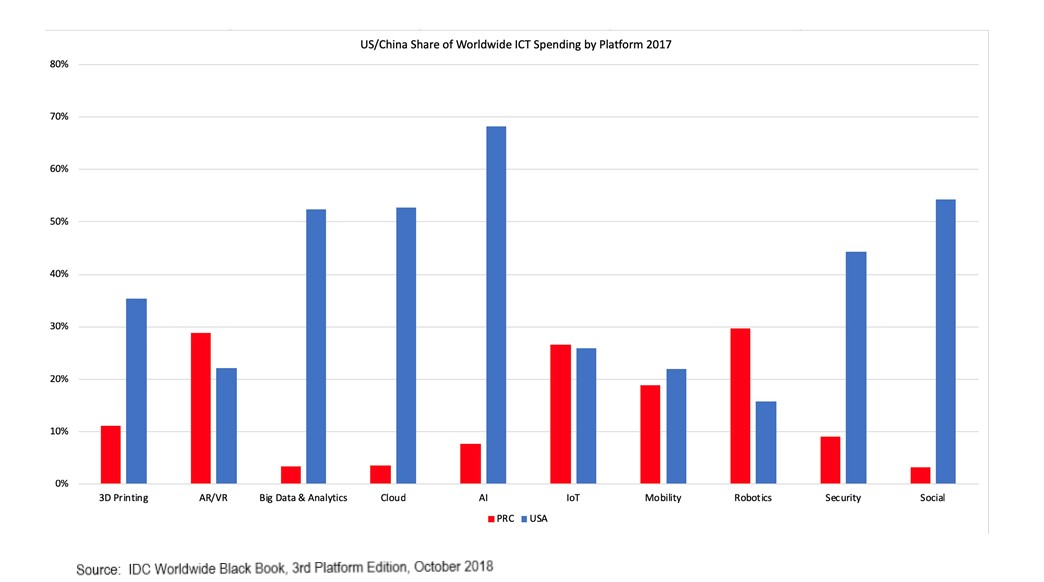

Towards the end of the forecast period, IDC predicts growth accelerating to more than 6 percent per year, as new categories such as drones, sensors, augmented reality and virtual reality (AR/VR), and 3D printers account for an increasing share of the market. According to the latest version of the Worldwide Black Book: 3rd Platform Edition from IDC, there are significant differences between major countries when it comes to the speed at which some of these new technologies are being adopted. These differences are no more pronounced than when comparing the United States and China.

China has emerged as the world’s largest market for spending on the Internet of Things (IoT), AR/VR, and robotics. By 2022, China will account for nearly 40 percent of worldwide robotics spending, with almost $80 billion (€69.1 billion) in annual expenditures, and the nation already accounts for more than a quarter of global spending on IoT and AR/VR. Meanwhile, the US continues to dominate spending on software-driven markets and currently accounts for almost 70 percent of total spending on artificial intelligence (AI), and more than 50 percent of Big Data & Analytics (BDA). US annual spending on AI will grow to nearly $50 billion (€43.2 billion) by 2022, while annual BDA investments will reach $140 billion (€121 billion).

“The US is still leagues ahead of other countries when it comes to software spending in general and early-stage software deployments in particular,” said Stephen Minton, Vice President of Customer Insights & Analysis at IDC. “That’s partly related to general recognition by US firms of the productivity benefits related to software investments, partly to a strong local ecosystem of vendors and channel partners, and also partly to the rapid adoption of cloud computing in recent years. Cloud enables fast, scalable deployment of new software applications and it’s no coincidence that the US is also way ahead of other countries when it comes to migration to the cloud.”

In 2017, the US accounted for 54 percent of all cloud-related ICT spending worldwide, at $145 billion (€125.3 billion). This included $70 billion (€60.5 billion) in spending on cloud software, $35 billion (€30.2 billion) on cloud-related IT services, and $10 billion (€8.64 billion) on infrastructure as a service. The US accounted for almost 70 percent of worldwide cloud software spending, while China accounted for just 1.5 percent.

“There is a clear divergence between the US and China when it comes to current strengths and leadership in ICT adoption,” explained Minton. “The US continues to achieve broad-based economic benefits from aggressive investments in software, while China’s focus so far has been on a more narrow segment of economic growth and ICT enablement, including rapid adoption of operational technology in IoT and robotics related to manufacturing use cases. While the US must ensure that it continues to invest in new software innovation, China’s challenge is to diversify its ICT investments in order to achieve broader economic benefits.”

The current trade war between the US and China threatens to disrupt both countries and their ability to implement their goals in the next five years. While spending on new technologies has not yet shown a significant slowdown, IDC expects any escalation in the trade war to be a drag on traditional technologies in the first half of 2019. Spending on new categories would likely begin to slow by 2020 if businesses are forced to reassess their budgets. For the US, the risk is that an economic slowdown could damage its leadership in new software categories. For China, the government would be constrained in its stated goal of diversifying the country’s economic growth.

Other regions may also be caught up in a trade war with the US to some extent, especially as protectionism begins to affect worldwide GDP. For now, however, pockets of growth and strong investment have emerged in various places. For example, India is showing strong growth in spending on cloud-related deployments with annual growth of more than 30 percent expected throughout the next five years (almost double the worldwide average). AI projects are seeing explosive growth in Japan, which was the second largest AR/VR market last year ahead of the US, while Germany has emerged as an early leader in adoption of 3D printing as the second largest market in 2017 ahead of China. There are also examples of smaller countries investing in new technologies, which promise to deliver rapid economic benefits.