The start of Q3 2019 saw printer sales continue to follow the pattern that has characterised the past few quarters, with healthy demand from consumer and business laser multifunction printers (MFPs), according to the latest distribution data published by CONTEXT.

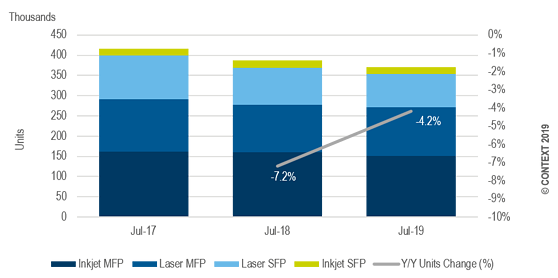

CONTEXT’s latest data published shows volume sales of printers through Western Europe’s (WE) largest distributors were down by 4.4 percent year-on-year in July 2019. The sharp growth of 9.1 percent in sales of laser MFPs (mainly driven by the exceptional growth of 30 percent year-on-year in the consumer segment during early Q3), was offset by the sharp decline of inkjet devices (SFPs -15.5 percent and MFPs -6.4 percent) and laser SFPs (-6.9 percent). With distributors reporting that reseller demand for SFPs, particularly lower-spec models, is low, the ongoing shift from single- to multifunction devices is likely to be further consolidated.

Business laser MFPs, which account for 73 percent of sales and 89 percent of revenue, registered a small year-on-year volume growth of 2.9 percent in July 2019, leading to an increase in revenue of 9.3 percent and reversing the negative trend the market saw in 2018 and 2019.

Sales of, and revenues from, laser MFPs increased in almost all WE countries in July 2019. In Italy, overall printer sales continued to grow in terms of both units and revenues (+14 percent and +28 percent year-on-year respectively) with most retailers and small resellers buying from distributors thanks to their ability to offer credit lines and smaller minimum order sizes.

Vendors are also benefiting from this shift which transfers financial risk to the distribution channel. However, the question now is how much distributors will ask from vendors to compensate for the higher risk they are taking, CONTEXT stated.

The United Kingdom also registered strong year-on-year growth in sales of laser MFPs in July 2019, in terms of both units (+12 percent) and revenues (+11 percent), driven by the business segment (+9.2 percent) which accounts for 87 percent of laser MFP sales (96.4 percent in terms of revenue) in the country. Consumer laser MFPs registered outstanding growth (sales up by +33 percent and revenue +31 percent) but they only account for 13 percent of sales and 3.6 percent of revenue.

It is expected that both consumer and business demand for laser MFPs will remain strong throughout the second half of 2019 as new products become available.