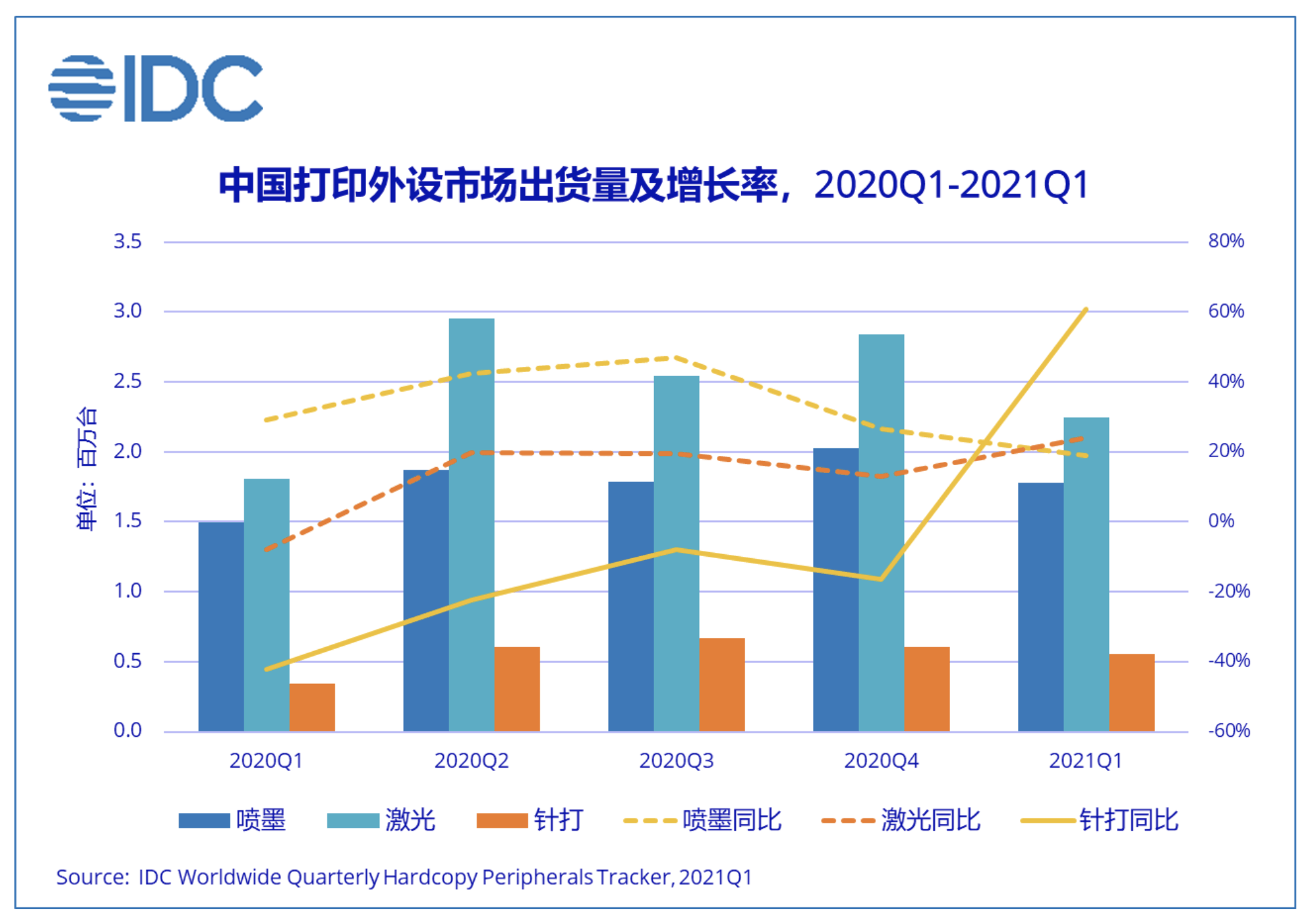

IDC’s latest “China Printing Peripheral Market Quarterly Tracking Report (First Quarter 2021)” shows that in the first quarter of 2021, China’s printing peripheral market shipments were 4.579 million in Taiwan, an increase of 25.3% year-on-year (YoY).

IDC’s latest “China Printing Peripheral Market Quarterly Tracking Report (First Quarter 2021)” shows that in the first quarter of 2021, China’s printing peripheral market shipments were 4.579 million in Taiwan, an increase of 25.3% year-on-year (YoY).

Inkjet printer shipments were recorded as 1.781 million, a year-on-year increase of 18.8%; laser printer shipments were 2.243 million, a year-on-year increase of 23.9%; stylus printer shipments were 554,000, a year-on-year increase of 60.8%.

In the first quarter of 2021, China’s printer market supply shortage was still present, but both the laser, inkjet and injection markets are showing a higher year-on-year growth momentum. In addition to the market decline caused by the pandemic, the size of the printing equipment market in the first quarter of this year also exceeded the normal level of the first quarter of 2018 and the first quarter of 2019.

In the first quarter of this year, with the effective control of the pandemic and the gradual normalisation of production and life, consumer market demand fell, and shipments fell by 6.1% year-on-year. However, there are still opportunities for growth in the family education (mainly K12 education) market according to IDC.

The Ministry of Education recently released the “Child and Adolescent Myopia Prevention and Control Bright Action Work Plan (2021-2025)”, which requires “teaching and assignment of homework do not rely on electronic products, use in principle, the teaching time for electronic products should not exceed 30% of the total teaching time. In principle, paper-based assignments are used.” IDC believes that the announcement of this policy will affect the growth of education-related print volume to a certain extent and drive related printing demand in the education industry and the home market.

Since March, the supply shortage has gradually expanded from international manufacturers to domestic manufacturers. IDC added that the current market demand is still relatively strong, which corresponds to the shortage of supply caused by various factors such as chip shortages and rising prices of raw materials. The market price of printing equipment continues to rise, resulting in a strong willingness of dealers to stock up, which has also greatly promoted the growth of printer market shipments.

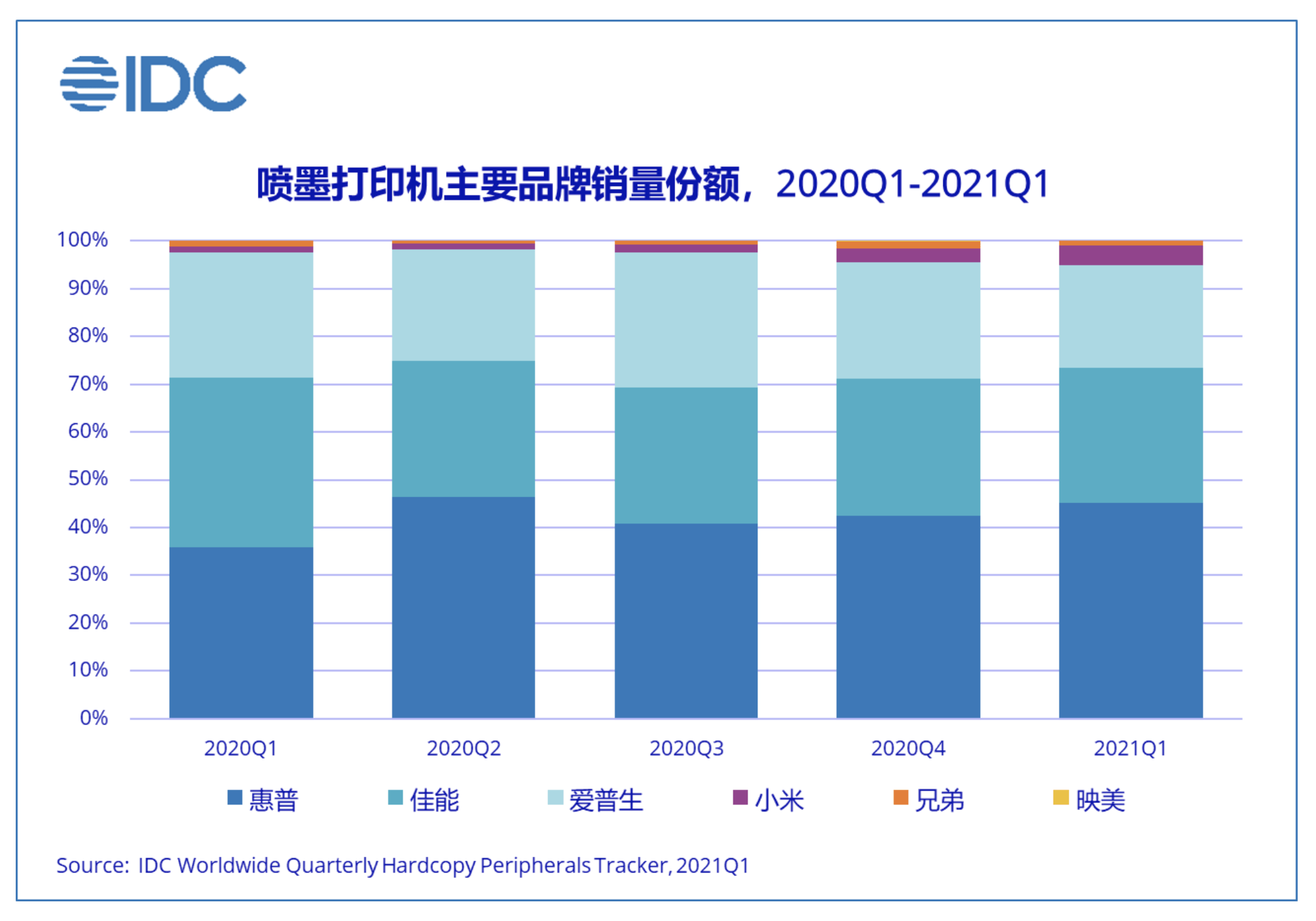

In the first quarter, HP’s active sales strategy and strong supply helped its share continue to grow, occupying nearly half of the market, widening the gap with other brands; Canon and Epson were affected by the lack of stock, and their market share declined to a certain extent.

The laser printer market maintained a relatively high growth in the first quarter, mainly due to the obvious decline in market size caused by the impact of the pandemic in the first quarter of 2020. In the first quarter of this year, the market size has returned to the normal level of previous years.

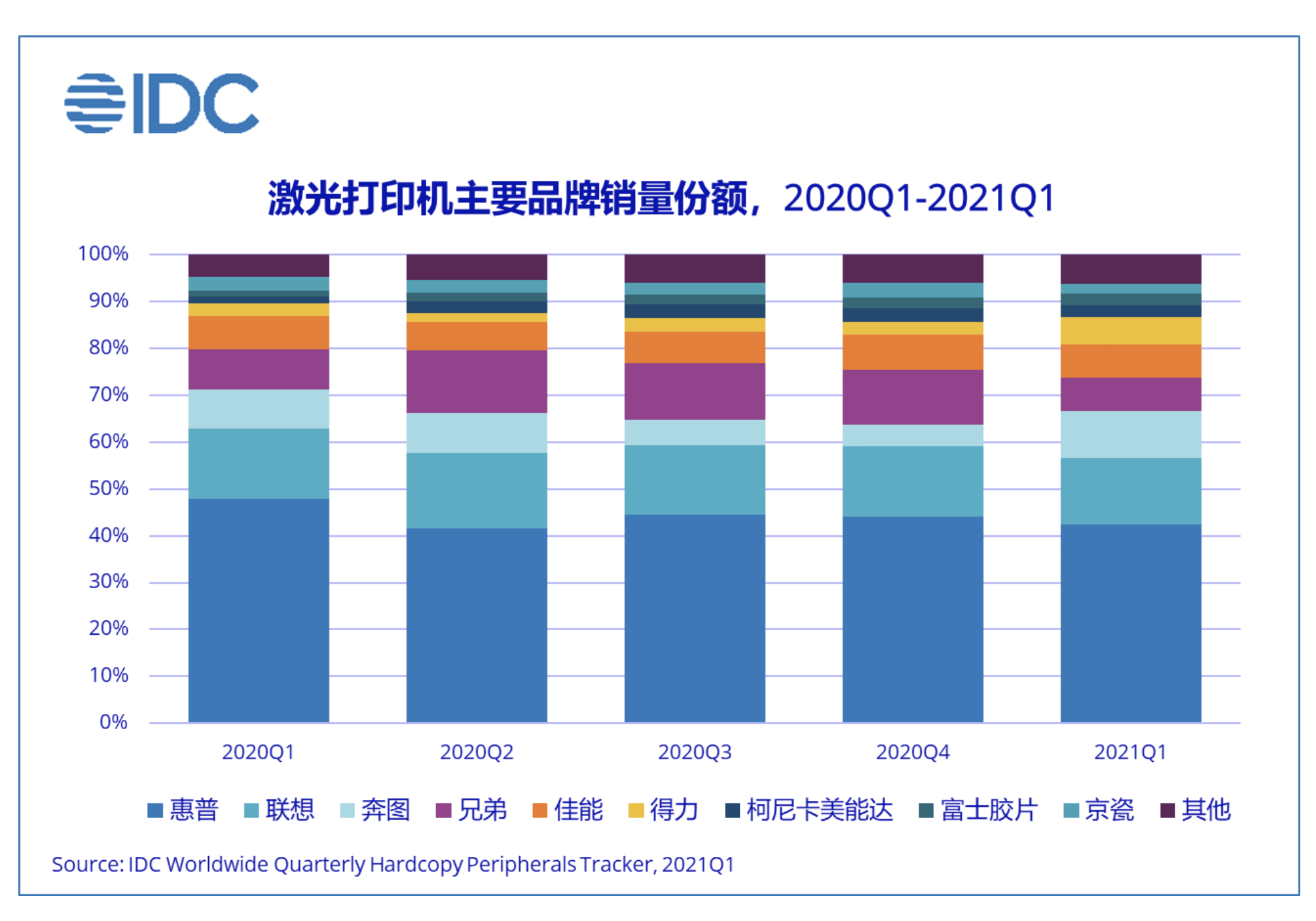

Affected by the shortage, some international manufacturers such as Hewlett-Packard, Brother, and Kyocera have declined in market share. Domestic brands such as Pantum were not affected by the shortage in the first quarter, and their market share expanded.

However, as the supply of chips and components continues to be insufficient and overseas waves of the pandemic continue, IDC believes that most manufacturers will face pressure in supply in the second quarter. With reference to the information currently available, the overall supply problem may be gradually alleviated in the second half of the year.

However, as the supply of chips and components continues to be insufficient and overseas waves of the pandemic continue, IDC believes that most manufacturers will face pressure in supply in the second quarter. With reference to the information currently available, the overall supply problem may be gradually alleviated in the second half of the year.

Ren Mengxue, a Senior Analyst at IDC China’s Printing, Imaging and Document Solutions Research Department, believes that in the face of this year’s complex and volatile supply and demand conditions, manufacturers with faster decision-making mechanisms and flexible production capabilities will have more room for development; manufacturers should pay close attention to policy changes and the needs of market segments, and actively respond to product and marketing strategies.