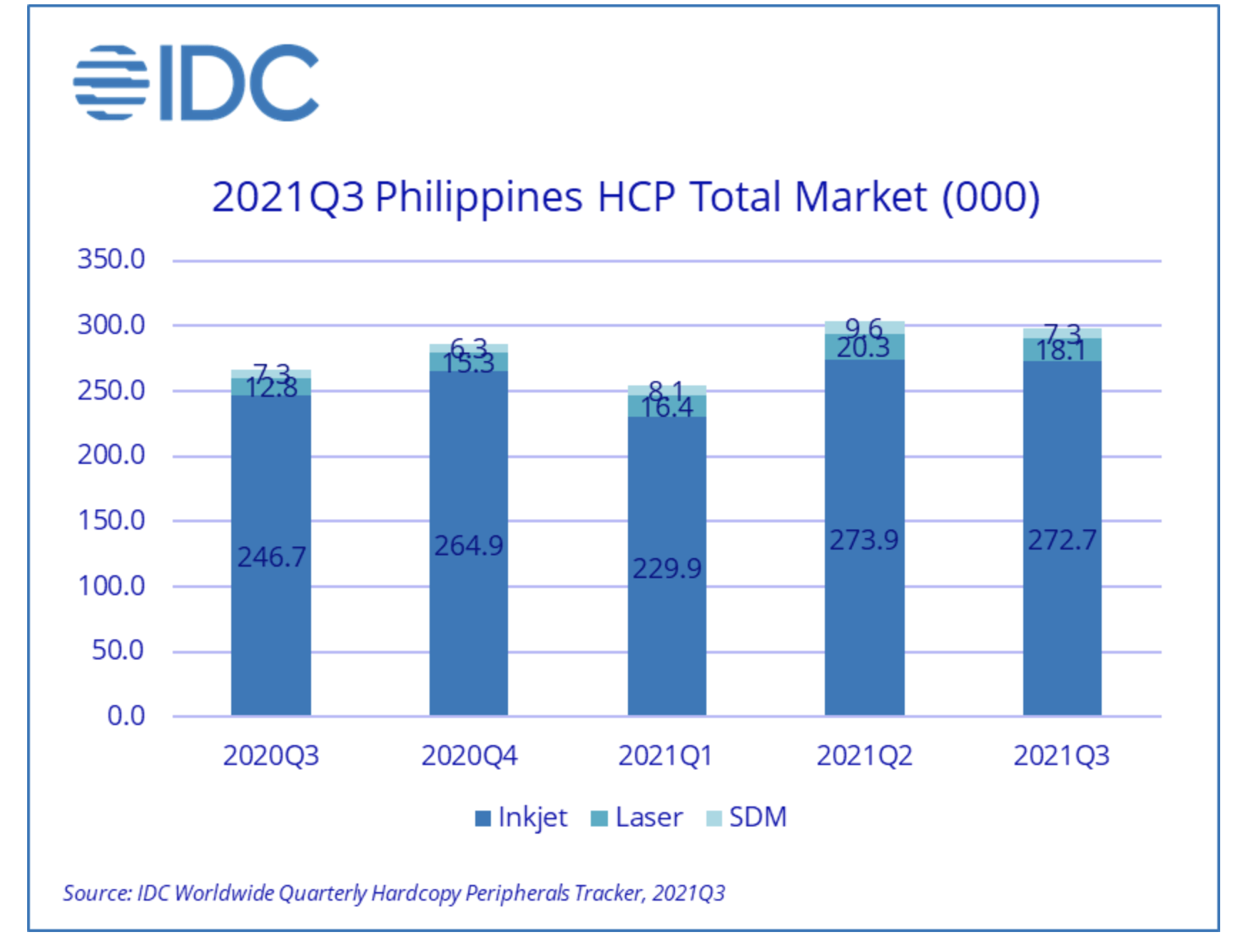

The 2021Q3 Philippines HCP market, including inkjet, laser, and SDM grew 11.7% year-on-year, according to the International Data Corporation’s (IDC) Worldwide Quarterly Hardcopy Peripherals Tracker.

This was the fourth consecutive quarter of year-on-year growth. Despite ongoing challenges with the global shortage of chips and semiconductors, and reimposed strict lockdowns, the continuous demand from consumers and improvement in the SMB segment, heavily contributed to the market growth.

“In quarter three, the overall printer market continued to show significant year-on-year growth with an almost negligible decline quarter-on-quarter. Comparing last year, when most brands were filled with backorders due to a sudden increase in demand from the consumer and education segment, this year’s stocks are catching up and backorders have been fulfilled gradually. Although stocks shortages are still a challenge, brands were able to manage their stocks accordingly to make sure the demand across all segments met,” said Lilibeth Agudo, IPDS Market Analyst at IDC Philippines.

“In quarter three, the overall printer market continued to show significant year-on-year growth with an almost negligible decline quarter-on-quarter. Comparing last year, when most brands were filled with backorders due to a sudden increase in demand from the consumer and education segment, this year’s stocks are catching up and backorders have been fulfilled gradually. Although stocks shortages are still a challenge, brands were able to manage their stocks accordingly to make sure the demand across all segments met,” said Lilibeth Agudo, IPDS Market Analyst at IDC Philippines.

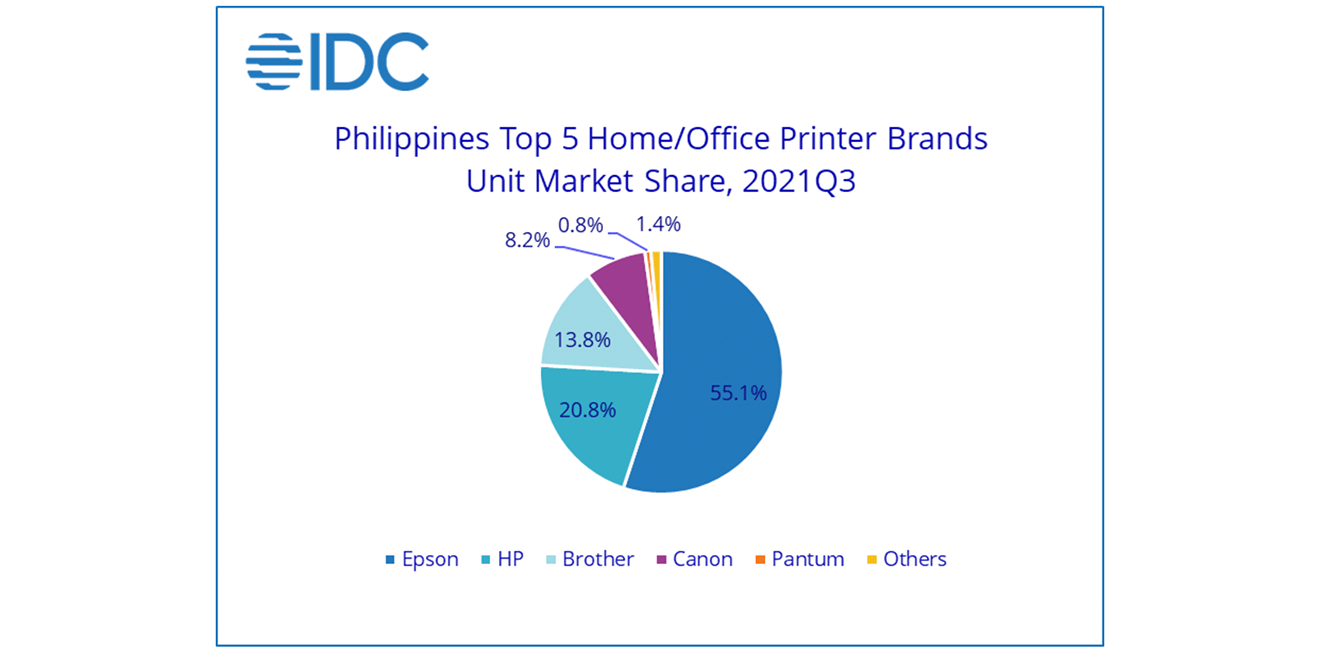

Top three home/office printer brands highlights:

Epson maintained to reign the top position in the overall Philippines’ printer market with a 55.1% market share. Although they refreshed their L series model line-up, they still faced challenges in bringing in more stocks due to shortages. Epson made sure that stocks are being allocated properly to their partners as they continuously receive back-to-back orders from them. The retail-driven demand still caters to consumers and SMBs, which continues to recover.

HP made its way to the second position, recording 20.8% of the share. Allocation for stocks in the Philippines has improved in Q3 for both their inkjet and laser products which resulted in fulfilling backlogs from their partners while maintaining a healthy inventory. Demand remains to be driven by the consumer segment for their inkjet models but also seeing improvement in the corporate side, particularly for their ink tank models. Aside from winning a large government project for their laser product, the small and medium businesses’ demand contributed to the overall growth.

Brother holds 13.8% of the share. Despite slipping into the 3rd spot, they show a significant year-on-year growth of 76.3% in 2021Q3. The consistent growth of their laser printer products due to the reopening of more industries from services, banking, and small businesses drove the shipments. Additionally, the availability of their laser printers in the retail space also contributed to the growth. Inkjet, on the other hand, remains to get good demand as they focus on their wireless models that cater to printing environments with multiple users like households for work from home and home-schooling use.

“Comparing last year with stricter restrictions, this year witnessed a good economic growth due to more business allowed to operate and increase in vaccination rate. This resulted in recovery across all segments despite conservative spending and minimal projects available. For 2022, the outlook remains to be optimistic with more employees starting to go back to offices, thus will help drive back printing demand. Though factors such as the adaptation of hybrid working and the pandemic situation development might affect the overall demand,” Lilibeth added.