Tenth Quocirca MPS Market Landscape Report finds growth in MPS spend has slowed and vendors are diversifying as office print volumes are set for slow recovery.

Tenth Quocirca MPS Market Landscape Report finds growth in MPS spend has slowed and vendors are diversifying as office print volumes are set for slow recovery.

Quocirca published the tenth edition of its comprehensive insight into the Managed Print Service (MPS) competitive market landscape. Quocirca was the first analyst company to launch research into the MPS market and has been tracking developments in the industry since 2009. This most recent edition shows the impact of COVID-19 on office print volumes and remote working, trends in MPS spending, the accelerated drive for digital transformation and the push to cloud print services.

The report draws on primary research conducted among IT decision makers (ITDMs) in organisations with over 500 employees, in the UK, France, Germany and the US.

Key findings include:

- 79% say they will reduce their office footprint in some form, (44% plan to reduce capacity in existing offices; 23% plan to consolidate offices; 11% will close some locations permanently; 1% will switch fully to remote working).

- 47% of employees are now working remotely.

- 50% of respondents say their office print volumes reduced during the pandemic, with 33% expecting print volumes to be lower when offices reopen.

- 40% expect home print volumes to increase over the next year.

- 46% have provided approved home printers for selected remote workers.

- 53% of ITDMs expect MPS spending to increase over the next year, a drop from 79% in 2019.

- The top three additional services that most influence MPS supplier selection are workplace services; cloud print services and sustainability services.

- 39% of respondents said they have already implemented a cloud print management platform; 37% plan to do so.

Commenting on the findings, Quocirca Director Louella Fernandes said: “There will be no rapid return to pre-COVID-19 print volumes. Businesses are planning office consolidation, capacity reduction and, in some cases, closure.

“Hybrid working is here to stay and MPS providers must position themselves to assist clients with home printing and information security, but also a wider range of complementary workplace services that help implement the accelerated digital transformation prompted by the pandemic and aid home-office collaboration in the hybrid environment.”

Businesses with fully outsourced MPS are seeing the value of their investment, as 52% have used it to provide printers to home workers. However, 44% said they purchased devices online and 10% used specific B2B online stores such as Amazon business.

Louella said: “Speed of purchase and delivery were critical for businesses switching quickly to home working. Online stores were well-positioned to capitalise on this demand, but MPS providers must be vigilant to avoid losing out to online competitors. By developing a programme that rolls home office devices into the MPS engagement they can help customers tackle the security and technology deltas that arise from shadow IT purchasing.”

Supplier selection criteria: Workplace Services, Cloud Services and sustainability

As the digital transformation drive accelerates post-pandemic, IT decision makers are looking for a broader offering from technology partners. The provision of workplace services was the top factor that would make organisations more likely to select an MPS provider, with 56% saying this would influence their choice. This was followed by cloud print services, which were important to 45%, and sustainability services, a key selection factor for 30%.

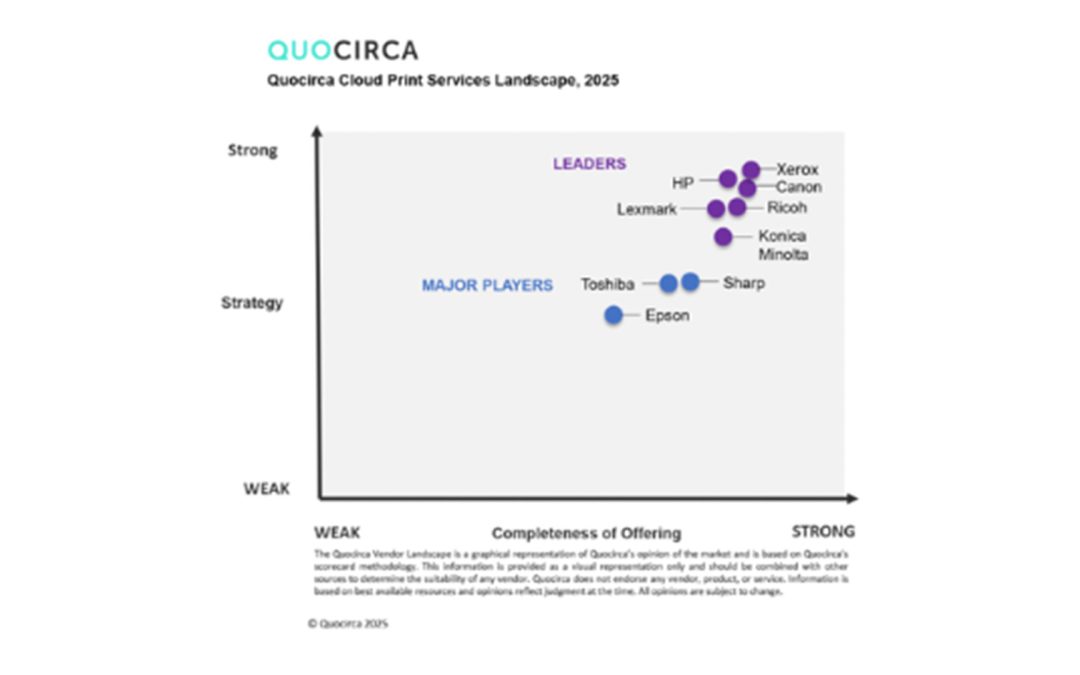

This underlines the growing cloud print service opportunity. 39% of respondents said they have already implemented a cloud print management platform, with a further 37% planning to do so.

Vendor evolution and office revolution

Over the ten years that Quocirca has been monitoring the MPS market landscape the industry has matured and evolved as vendors have responded to the digital transformation and cloud revolutions. Quocirca says that now they must transform again to support the rapid shift to hybrid working prompted by an unprecedented global health crisis.

Louella reflects on the changes over the past decade: “The emergence of MPS was a major shift from a transactional, hardware and consumables-based business model to a more consultative, service-based approach. MPS providers accomplished this shift through innovation and determination, despite the challenges of having to completely overhaul heavily embedded legacy culture.

“Each vendor has brought its own expertise to the challenge and customers now have a strong range of options to choose from. However, now office MPS specialists must adapt to something that seemed unlikely even 18 months ago: a fundamental shift away from the central office as a primary workplace model. Once again, the industry must adapt and show how it can maintain relevance as a workplace enabler – wherever the workplace is located.”

Quocirca’s MPS market landscape report contains detailed market and vendor analysis providing a comprehensive insight into the drivers, priorities and direction of the industry into 2021.

Download the complimentary executive summary or purchase the full report.