Mitsubishi Chemical to close Diacron resin operations, following Mitsui and earlier toner exits.

Mitsubishi Chemical to close Diacron resin operations, following Mitsui and earlier toner exits.

Mitsubishi Chemical Group Corporation has confirmed it will withdraw from the polyester toner resin market, ending production of its Diacron™ resin by 31 March 2026 and ceasing sales by 30 June 2026. The company cited long-term decline in demand, rising input costs, and poor profitability as the main reasons for the decision.

The announcement marks the third major Japanese withdrawal from the toner material supply chain in recent years, following Mitsubishi’s earlier exit from pulverised toner in 2018 and Mitsui Chemicals’ decision to leave the toner binder resin sector in 2024.

The Diacron™ resin, used as a binder in chemically produced toner (CPT), has been manufactured at Mitsubishi’s Tokai Plant in Aichi Prefecture since 1989. It is valued for its low-temperature fusing performance, image quality, and low emissions. In its official statement, Mitsubishi said: “After comprehensive consideration of possible alternatives, we have concluded that recovery and growth in this business are unlikely.”

Follows earlier exits

This is not the first time Mitsubishi has stepped away from the toner business. In 2018, the company exited the pulverised toner market after more than 40 years of production. That decision was driven by price pressure from low-cost Chinese producers and rising environmental concerns around high TVOC emissions from counterfeits. The Recycler reported on that move in: Mitsubishi calls time on pulverised toner.

In 2024, Mitsui Chemicals also announced it would stop producing both its ALMATEX™ styrene-acrylic and ALMASTAR™ polyester toner binder resins. That decision, too, was attributed to declining print volumes and lack of profitability. The story was covered here: Mitsui withdraws from toner resin market.

Who remains in the market?

With Mitsubishi and Mitsui stepping out, the list of major toner resin suppliers is shrinking. The largest remaining player is Kao Corporation, which supplies custom polyester resins for many OEMs under the Tuftone™ and Lunatone™ brands. Kao is widely regarded as the market leader in toner binder resin, supporting both technical performance and environmental compliance.

Dianal America, a Mitsubishi Chemical subsidiary, continues to produce polyester resin grades in the US and Japan, although their future in the sector remains unclear following the parent company’s withdrawal announcement.

Other Japanese suppliers still hold significant market share, but many are smaller or focused on domestic output. In recent years, new suppliers have emerged from China, Korea, and Taiwan. However, these regional producers may lack the technical depth or stability required for higher-end colour toner applications.

What it means for OEMs

OEMs that have relied on Diacron™ resin will now need to requalify alternative suppliers. This process involves technical testing, formulation adjustments, and compliance checks, especially where VOC limits and low-temperature fusing are concerned.

With fewer trusted suppliers in the market, price leverage weakens, and lead times may increase. The risk of delivery delays or resin mismatches also grows if multiple OEMs transition to the same supplier simultaneously.

A senior executive at one OEM, given anonymity to speak candidily told The Recycler: “We’re evaluating dual-sourcing strategies. The withdrawal of two major suppliers in six years is too big to ignore.”

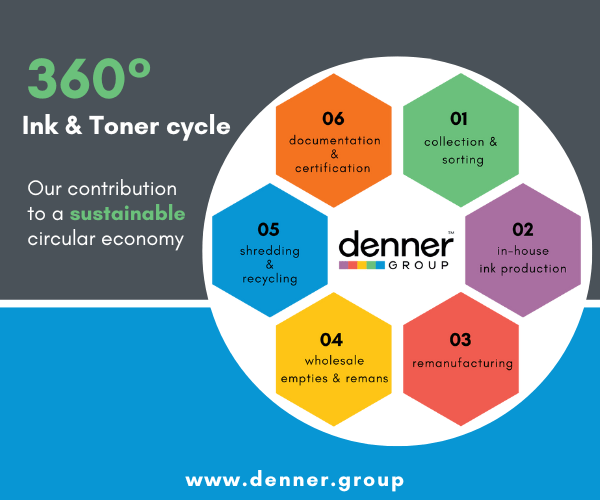

Implications for remanufacturers

For remanufacturers, the impact may be more acute. Diacron™ has long been a preferred resin for those looking to match OEM quality while maintaining low emissions. Smaller remanufacturers or contract fillers may now find themselves squeezed by rising prices, limited availability, or uncertain quality from unproven sources.

Larger remanufacturers with in-house R&D may adapt more easily, qualifying new resin sources and adjusting formulations. But even they face the challenge of securing long-term, stable supply, particularly for colour toner.

One toner manufacturer told The Recycler:

“We’ve relied on Japanese-grade resin for years. With both Mitsui and Mitsubishi out, we’ll need to reassess our whole supply chain.”

A changing market

The exit of Mitsubishi Chemical from the polyester toner resin sector underscores a deeper structural shift in the industry. Declining page volumes, digitisation, and rising costs are pushing legacy suppliers to refocus on more profitable or sustainable areas.

For manufacturers and remanufacturers alike, the challenge now is to navigate this changing landscape, balancing performance, compliance, and cost, while securing a new generation of reliable resin suppliers.