Japan’s remanufactured toner industry faces mounting pressure as HAMODA Inc. collapses, reflecting a market in decline amid rising costs and OEM competition.

By Koichi Yoshizuka, CEO & Founder of QRIE

Japan’s remanufactured toner industry is undergoing a prolonged downturn, with the recent bankruptcy of HAMODA Inc. serving as a stark reminder of the challenges facing small-scale businesses. The sector, once a viable alternative to OEM consumables, is struggling against falling demand, rising costs, and increased competition from both OEM and non-OEM players.

Japan’s remanufactured toner industry is undergoing a prolonged downturn, with the recent bankruptcy of HAMODA Inc. serving as a stark reminder of the challenges facing small-scale businesses. The sector, once a viable alternative to OEM consumables, is struggling against falling demand, rising costs, and increased competition from both OEM and non-OEM players.

A market in decline

According to an article published by Teikoku Databank on March 18, HAMODA Inc. (Capital: ¥1.5 million, Address: 275-3 Otawa, Fujiokamachi, Tochigi City, Representative: Mr. Obianike Odabi Abraham) suspended its business operations by March 11 and has begun preparations for bankruptcy proceedings.

HAMODA Inc.’s struggles reflect broader trends in Japan’s remanufactured toner sector. The Association of Japan Cartridge Remanufacturers (AJCR) reports that sales of remanufactured toner cartridges peaked at 5.79 million units in 2012. Since then, the market has contracted significantly, with sales dropping to 3.827 million units by 2023—a 34% decline. The COVID-19 pandemic further accelerated the downturn, with a sharp 12.3% drop in 2020 alone.

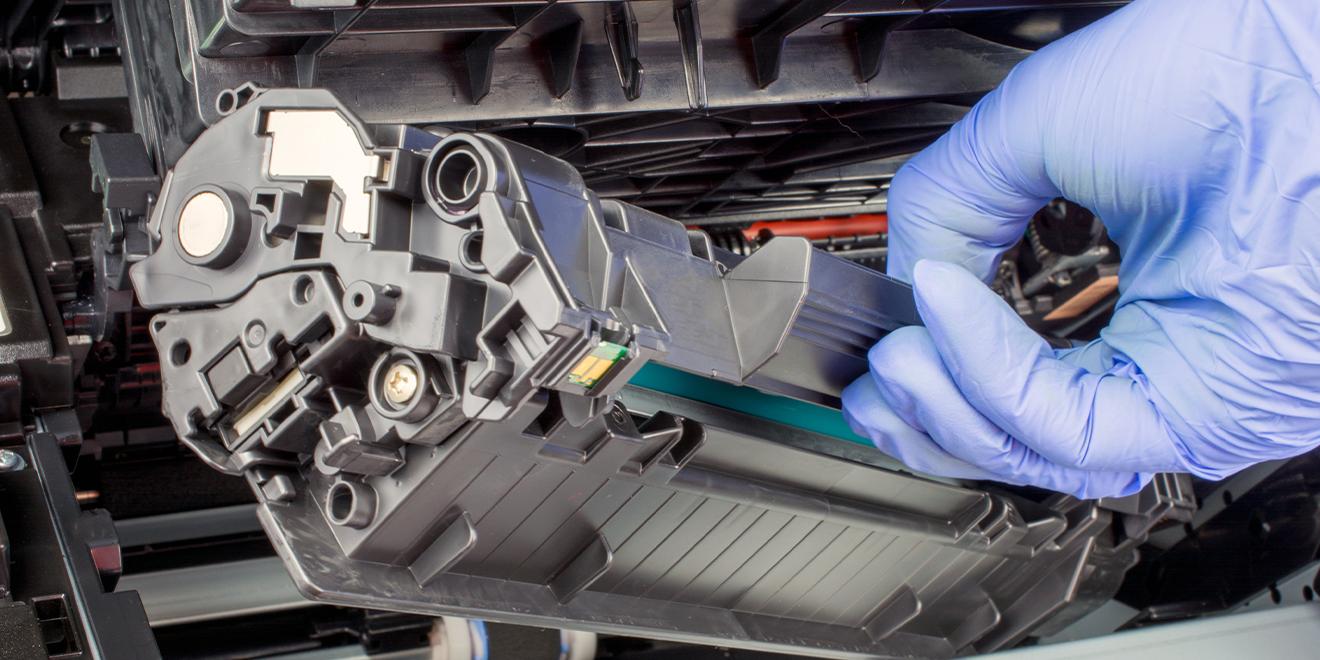

As companies increasingly shift to digital workflows and OEMs push aggressive pricing strategies on new toner products, the space for remanufactured alternatives has narrowed. Moreover, the rising cost of labour and raw materials has added pressure on remanufacturers, particularly smaller firms with limited financial flexibility.

HAMODA Inc.: A case study in market struggles

Founded in March 2014, HAMODA Inc. positioned itself as a reseller of remanufactured toner and ink cartridges, acting as a sales agent for major suppliers while also maintaining a direct-to-consumer business model. However, its small size—operated largely by a single representative—left it vulnerable to market shifts.

In an effort to revive its fortunes, the company relocated from Saitama to Tochigi in late 2024, but financial difficulties persisted. With estimated debts of ¥30 million (€190,000), the company ultimately ceased operations and began bankruptcy proceedings in March 2025.

Broader implications for the industry

HAMODA Inc.’s bankruptcy is a significant indicator of the pressures facing Japan’s remanufacturing industry. This contraction in demand, combined with rising operational costs and fierce competition from major manufacturers, has placed small-scale remanufactured toner companies in an increasingly vulnerable position.

Industry experts warn that unless remanufacturers can innovate, consolidate, or receive regulatory support, similar closures will continue. Japan’s remanufactured toner market is at risk of shrinking further as smaller businesses struggle to compete with larger players, including OEMs and producers of new-build compatible cartridges.

While demand for sustainable solutions remains, the remanufacturing sector must adapt to shifting market dynamics. The future may lie in strategic partnerships, increased lobbying for favourable regulations, and investment in more advanced remanufacturing technologies.

For now, Japan’s remanufactured toner industry faces an uncertain future, with smaller players in particular at risk of being forced out of the market.