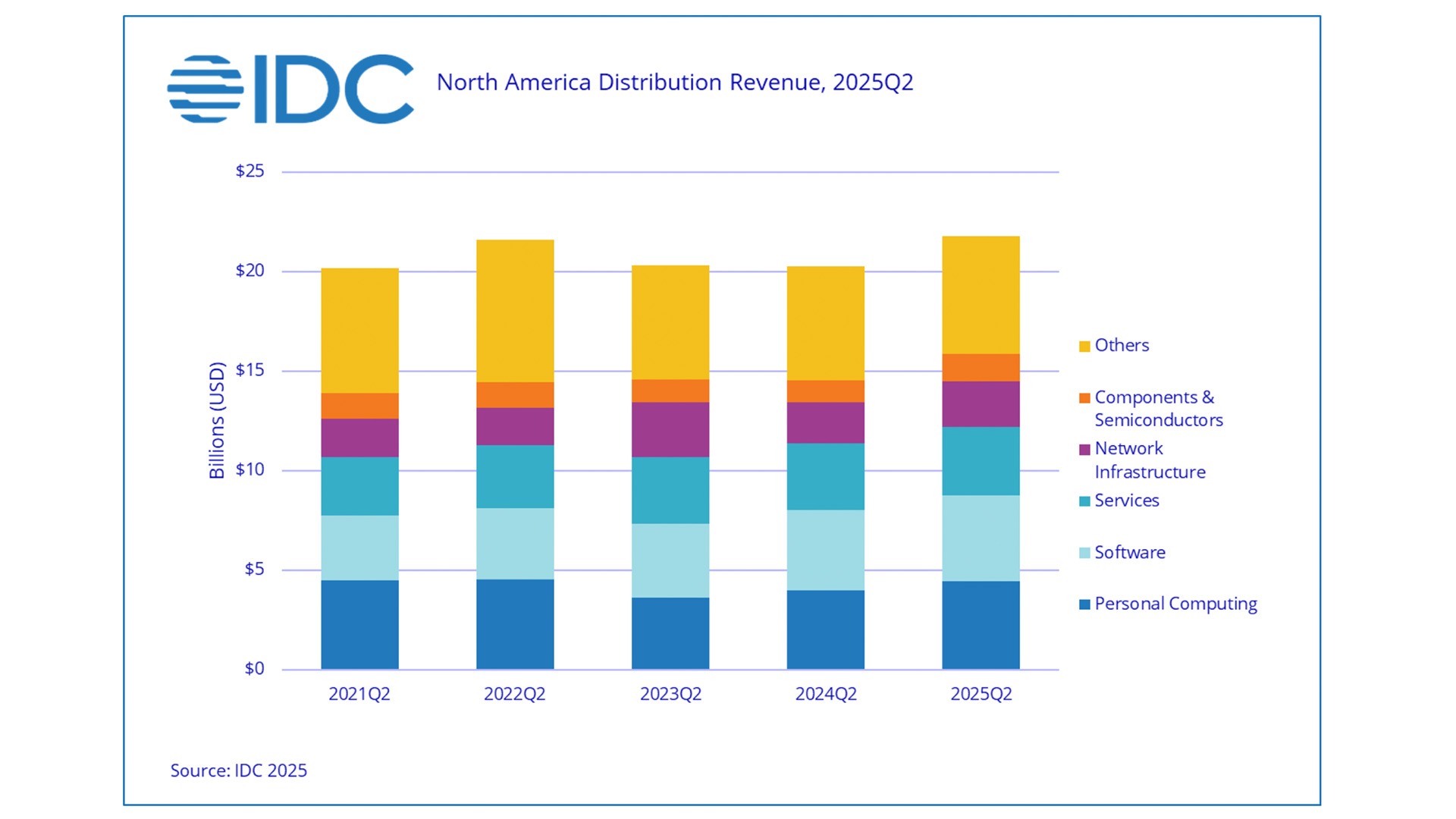

IT distribution revenues soar to new highs in Q2 driven by investment in AI, according to the IDC North America distribution tracker, powered by GTDC.

The IT distribution channel in North America posted record high sales in the second quarter of 2025, surpassing the previous Q2 high seen during the pandemic. Distributor revenues came in at $21.8 billion (€21.86 billion) which is a 7.4% increase year-over-year, according to the International Data Corporation (IDC) North America Distribution Tracker (NADT). All the largest categories grew in Q2 with hardware categories exhibiting the strongest growth; Personal Computing grew 12.1% year-over-year, Network Infrastructure grew 13.3% year-over-year and for the first time, Components & Semiconductors joined the top five product groups after recording 22.9% year-over-year growth. This growth for Components & Semiconductors is driven by a huge increase in sales through distribution of GPUs.

“The remarkable surge in GPU sales, exceeding 575% year-over-year, is largely driven by the unwavering emphasis on AI,” said Ruth Flynn, research vice president, IDC Tracker & Data Products. “With GPU supply chain constraints easing, the demand for AI infrastructure is expanding beyond major cloud service providers to large enterprises, and distribution channels are seizing the opportunity to meet this growing demand.”

The focus on AI is bolstering sales across many hardware categories. AI PC sales in Q2 generated nearly $2 billion (€1.73 billion) in revenue, reflecting a significant shift in the product mix of personal computing devices—from less than 10% AI PCs to over 25% within the past year.

The Network Infrastructure product group exhibited a healthy return to growth in Q2 and recorded $2.3 billion (€1.99 billion) in sales. Backlog orders have been deployed, and enterprises are putting in orders for new hardware that can keep up with AI workloads and leverage modern architectures.

And while software and services revenues didn’t grow as fast as hardware, these important categories still grew at 5.9% and 2.3% respectively year-over-year. Software and services revenues now represent approximately 40% of total sales through the distribution channel, as partners increasingly rely on distributors for their expertise in delivering multi-vendor solutions.

IDC’s North America Weekly Distribution Tracker and North America Monthly Distribution Tracker are built on the exclusive partnership between IDC and the Global Technology Distribution Council (GTDC) and provides the industry’s most comprehensive view of technology distribution data and market trends in the U.S. and Canada.

The data in these Trackers is actual sales data collected weekly from sales receipts across the largest distributors in North America for more than 1,000 brands over several years. This data is mapped to IDC’s taxonomy with over 200 categories organised into 13 distinct product groups with detailed product attributes across categories.