Material consumption in industrial metal 3D printing up 21 percent so far in 2019, the growing number of installed 3D printers focused on mass-production is leading to higher global utilisation of materials, says CONTEXT.

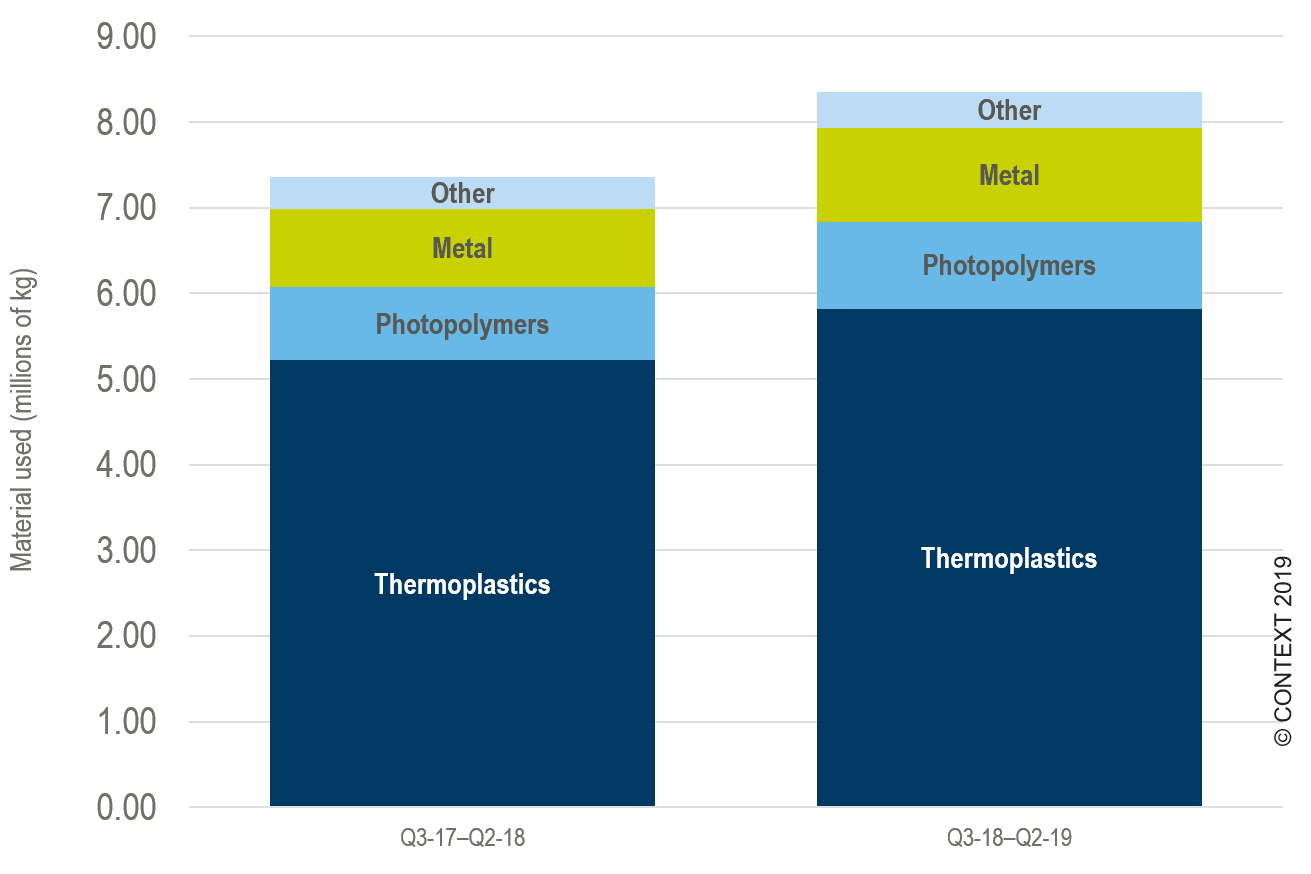

Its latest research update shows that only 28 percent of installed 3D printers costing over $5,000 (€4,532) fall into the industrial price class, but they accounted for 56 percent of all material used in the last year. There are currently more than twice as many industrial polymer (plastics) printers than metals printers installed but, in recent years, the metals side of the market has seen greater growth in both printer shipments and materials utilisation. On a trailing- twelve-month (TTM) basis through to Q2 2019, industrial metal-based 3D printers used 21 percent more material than in the previous year.

The two major trends that have driven material utilisation over recent years are the growth in the installed printer base; and the increasing use of new printers for serial mass-production rather than just prototyping. 3D printing has always excelled in mass-customisation (making thousands of slightly different parts for items such as clear dental aligners or hearing aids), but its ability to produce an ever-larger number of the same good is being made use of more often.

What is considered ‘mass-production’ cannot be defined in terms of specific unit volumes because it is relative to the market being described: it means something totally different for consumer electronics (where products need to be produced in their millions) than in, say, aerospace (where there is a market for only hundreds of a particular product), CONTEXT explains.

Each new generation of industrial 3D printer that has hit the market has pushed the envelope so that many printers are now able to produce not just hundreds of the same item in a reliable manner but tens – or even hundreds – of thousands. And, as more and more installed printers are able to mass-produce goods, the amount of material they require inevitably increases, CONTEXT adds.

Global shipments of metals 3D printers increased by 26 percent in 2018. Most of these (83 percent) were of the INDUSTRIAL varieties that are best suited to serial mass-production (either powder bed fusion or binder jetting). The resultant combination of a growing base and increased ability to produce more goods resulted in the use of 21 percent more material by industrial metals printers over the last year.

Industrial-class polymers printing has also seen gains over the last year with consumption up by 13 percent on a TTM basis. Consumption of the sub-set of polymers called thermoplastics rose by 11 percent – mostly thanks to the general trend toward the use of power bed fusion printers for serial production and, in particular, a growing installed base of models from HP, which saw material utilisation rise 40 percent over the year.

Photopolymers saw a year-on-year increase in materials use of 19 percent thanks to the growing number of DLP-based vat photopolymerisation printers installed, including new machines from Carbon as well as Figure-4/NextDent machines from 3D Systems and Envision One printers from EnvisionTEC.

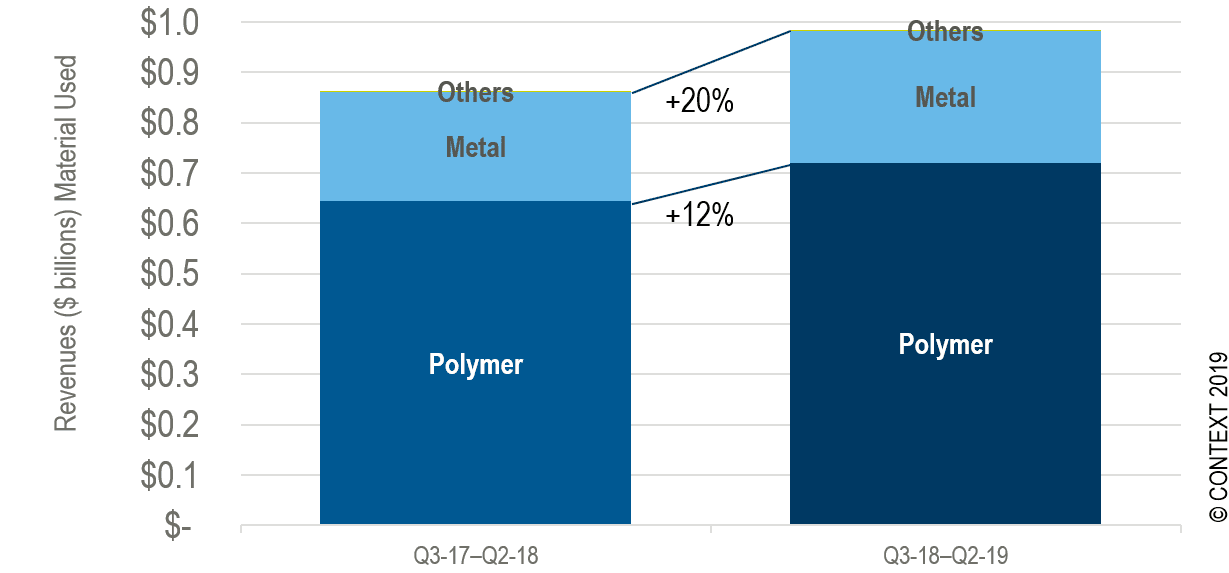

While companies are continuing to try to bring down the price of materials (which remains much higher, weight-for-weight, than that of those used in conventional manufacturing), the growing installed base means that the revenues they generate is still rising. Revenues from materials for industrial metals-focused additive manufacturing machines were up 20 percent on a TTM basis, and those from polymers for industrial printing up by 12 percent.