Indonesia’s Hardcopy Peripherals (HCP) market is down 1.06% in the fourth quarter of 2023 ahead of a political year, says IDC.

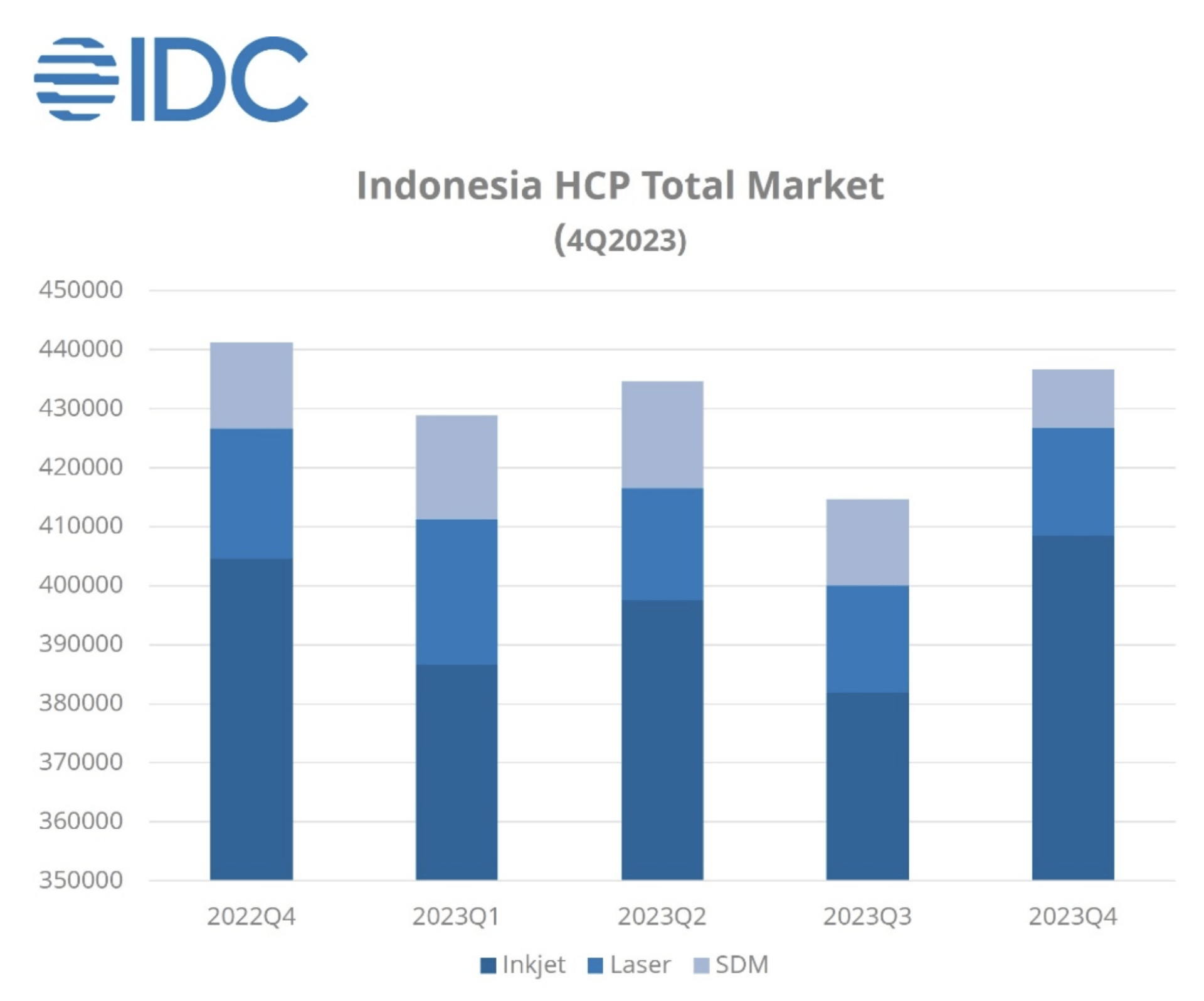

Recent data from the IDC Worldwide Quarterly Hardcopy Peripherals Tracker indicates a slight year-on-year (YoY) decline for Q4 2023 in the Indonesian Hardcopy Peripherals (HCP) market, which includes inkjet, laser, and serial dot matrix (SDM) at -1.06%, while at the same time posting a quarter-on-quarter (QoQ) growth of 5.3% from Q3 2023.

IDC explained that the decline occurred as major end users across the country deferred device purchases in Q1 2024, mainly due to the rising political and business uncertainties surrounding Indonesia’s election on 14 February.

IDC explained that the decline occurred as major end users across the country deferred device purchases in Q1 2024, mainly due to the rising political and business uncertainties surrounding Indonesia’s election on 14 February.

Vendors and channels have reported that since Q3, major end users have been delaying major investments and device purchases, with some verticals even deferring purchase contracts to 2024, after the elections.

Despite uncertain sentiments, Q4 2023 still marked the highest recorded shipments in 2023, primarily driven by a significant increase in inkjet shipments.

As Indonesian consumers continued to show improved market sentiments nearing the end of the year, vendors were keen to intensify their efforts to penetrate the mainstream consumers’ market. This was visible as new inkjet printer models which were launched in 2023 with more robust features and functionalities saw gradually increasing shipments, leading to greater performance for inkjet products, even as older models were gradually phased out.

“In Q4, we saw more projects from the government sector, aligning with their peak purchasing period at the end of the year to optimise budget spending,” said Leonard Adiarto Sudjono, Senior Research Analyst, IDC Asia/Pacific. “However, the private sector displayed a shift from previous years, adopting a more conservative sentiment and decreased their spending on new devices, choosing instead to defer their purchases after the elections when the political and business landscapes have become more certain,” added Sudjono.

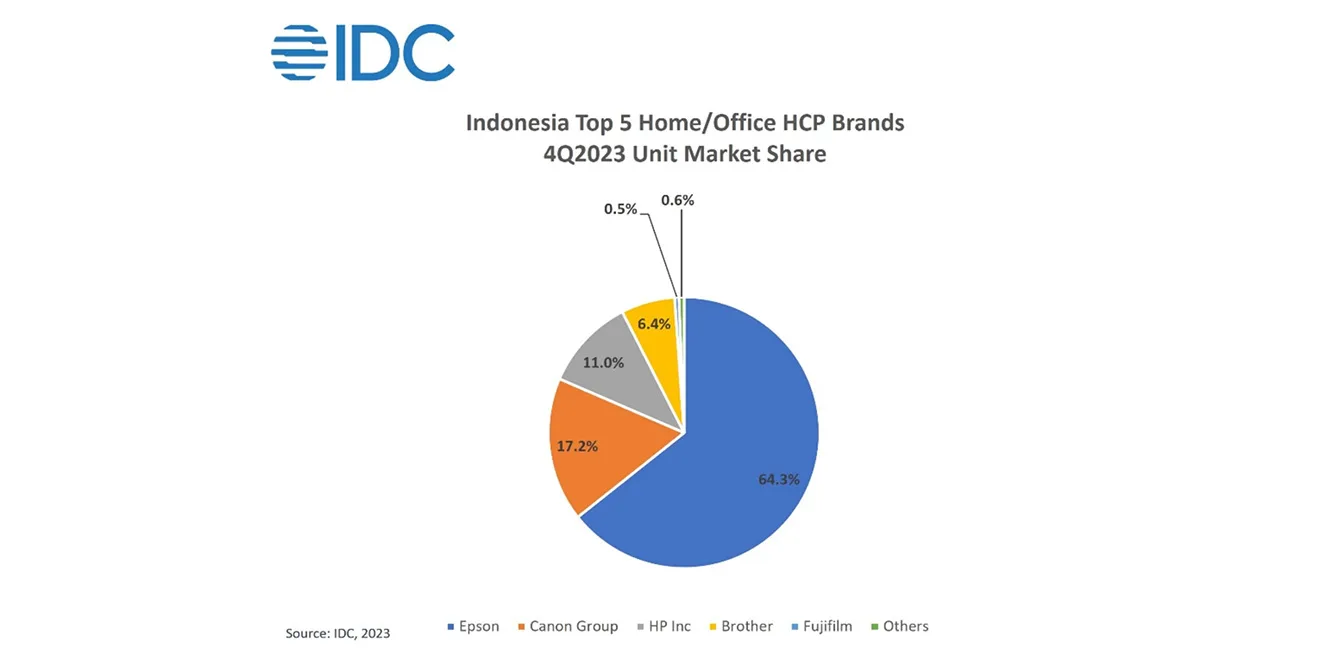

- Epson once again held the highest market share for home/office printers in Indonesia in 4Q23, accounting for 64.3% of the market thanks to their first mover advantage in introducing the ink tank models, which have become increasingly popular compared to ink cartridges.

- Canon still held the second-highest market share with 17.2% despite a decrease in shipments due to the phasing out of some popular models.

- HP followed in third position with an 11.0% share, intensifying their focus on the growing ink tank market.

- Brother managed to grow their shipments this year and managed to take the fourth position with 6.4% market share by strengthening their distribution network.

- Fujifilm, thanks to stellar performance in several key verticals, still managed to place fifth after the brand transition from Fuji Xerox, capturing a 0.5% market share with the new brand alone.

Top three home/office printer brand highlights:

- Epson continued to maintain their stable performance and growth in Indonesia. Thanks to the strength of their vast distribution network and favourable relations with channels, EPSON’s position is further solidified in this price-sensitive market despite having a higher price band in the low-end inkjet segment. Their high-end models also recorded better performance in 2023, mainly due to increased demand for TKDN-registered A3 MFP models such as L15150 and EcoTank M15140. Additionally, EPSON’s dominance in the SDM market was maintained as the Indonesian market still had a sizeable demand, coming mostly from the manufacturing and government verticals.

- Canon made a big step in phasing out the IP2770, a popular ink cartridge model which has become one of their most popular products. The shipment for this model decreased significantly in the second half of the year as other models were pushed to establish Canon’s position in the ink tank market. Despite this decision however, the market’s demand for this model has not dissipated, and shipment is still expected to continue coming into the market alongside the shipment of newly introduced ink tank models that came in 2023 such as the PIXMA G2730 and PIXMA G3770.

- HP increased their Smart Tank series shipments in 2023, marking a new record in their ink tank shipment number. Through their “Future Ready” campaigns held in several major cities, HP Indonesia introduced their Smart Tank models alongside other products such as laptops, mice, headsets as well as laser copiers to cater to both commercial and consumer markets.

“The Indonesian hardcopy peripherals market saw shipment fluctuations in 2023 with increasingly intense competition between brands in both the inkjet and laser segments. On top of this, the Indonesian economy is also bound to see changes beginning in 2024, as a leadership change comes into the scene after the previous president’s decade-long tenure. With the officiation of the new president scheduled to happen in the second half of 2024, the continuation of major projects, as well as new projects and changes to the government’s budget will bring about a new outlook for all brands in the Indonesian market,” ended Sudjono.