The lowered lockdown restrictions led to a slight increase in demand in Indonesia’s printer market, IDC says.

According to the International Data Corporation’s (IDC) Worldwide Quarterly Hardcopy Peripherals Tracker, Indonesia’s home/office printer market, including laser, inkjet and serial dot matrix registered overall shipment of 0.33 million units in 2021Q3 (July-September). The overall market also grew by 6.0% year-over-year (YoY) and 16.6% quarter-over-quarter (QoQ).

After Level 4 of lockdown in July, the government lowered the restriction to level 3 starting in mid-August and it led to market demand recovery. At the same time, the IT retail market was allowed to re-open, which had a positive impact on the recovery of overall printer demand. September was the period when vendors’ saw traction in demand; however, they could not maximise the opportunity due to stock shortages. The 2021Q3 period started where vendors officially increased printer price as the impact of spare parts and shipping freight price increment.

After Level 4 of lockdown in July, the government lowered the restriction to level 3 starting in mid-August and it led to market demand recovery. At the same time, the IT retail market was allowed to re-open, which had a positive impact on the recovery of overall printer demand. September was the period when vendors’ saw traction in demand; however, they could not maximise the opportunity due to stock shortages. The 2021Q3 period started where vendors officially increased printer price as the impact of spare parts and shipping freight price increment.

“The level of lockdown had a significant impact on the printer market, which affected the confidence level of the channel partners. Meanwhile, on the commercial segment, government allowed manufacturing companies to continuously operate with strict health protocols during lockdown level 4. The policy helped the print volume recovery and gave an opportunity to printer vendors to target manufacturing companies,” said Rino Rivaldi, Market Analyst at IDC Indonesia.

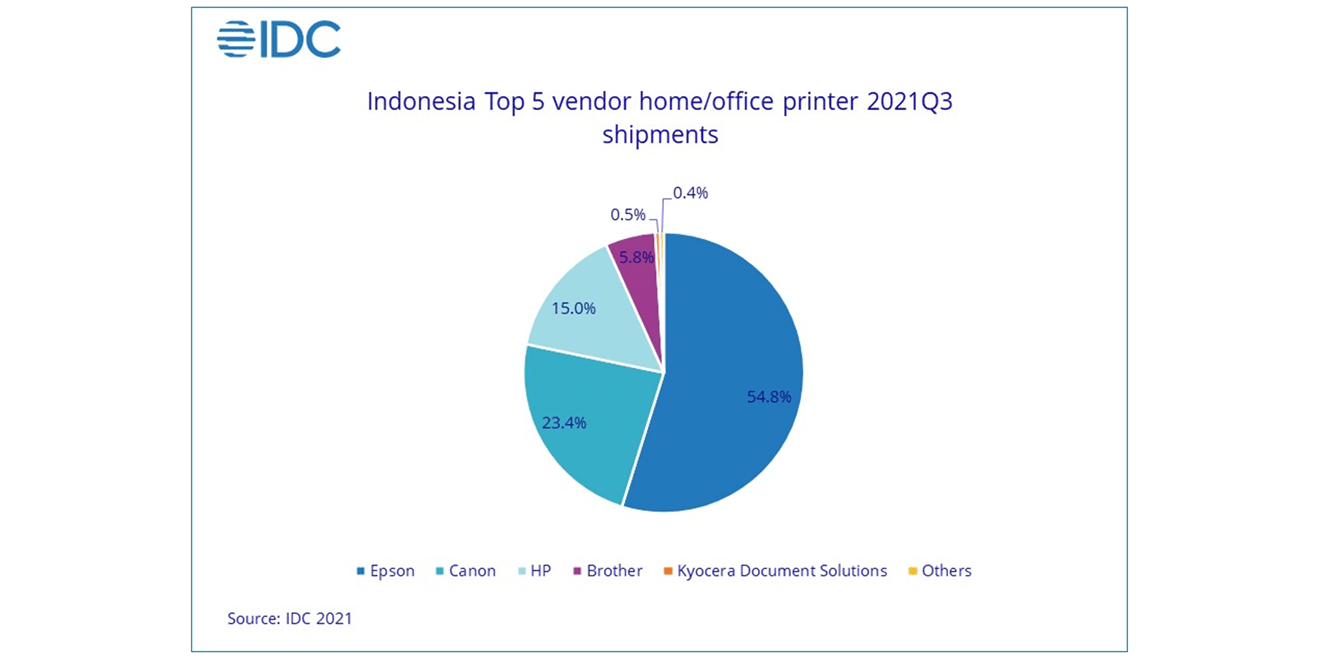

Epson remained market leader in the overall Indonesia 2021Q3 home/office printer market with a market share of 54.8% and shipments recorded a slight YoY growth of 1.3%. They remained to face a shortage for printer chips and other spare parts, which resulted in vendors officially increasing their price, which started in August 2021. Shipment frequency and vessel queue resulted in longer fulfilment time. Inktank remained the main contributor to Epson’s shipment, recorded a strong growth of 37.8% QoQ. Meanwhile, Serial Dot Matrix recorded a significant drop of -46.5% YoY. The digitisation era was the main challenge for SDM printer demand.

Canon maintained the 2nd position in 2021Q3 with 23.4% market share and 20.5% YoY growth. Ink cartridge model is the biggest contributor, although recorded decline of 18.4% YoY. Ink cartridge production was heavily impacted because of shortages, and Canon prioritised producing ink cartridge ‘hero models’ to minimise shortages effect. Inktank shipment recorded strong growth during 2021Q3 period. In the total laser segment (including copier-based MFP), the total market recorded a growth of 59.5% YoY. Although there’s a market recovery, copier based continues to be impacted by hybrid work trends and less employee working from their offices, resulting in underutilised machines.

HP is still at the third spot in the home/office 2021Q3 market with 15.0% market share, with significant shipment growth for ink tank of 156.0% YoY, while ink cartridge recorded a decline of -48.3% YoY. The ink cartridge declined because of the production challenges, but on the other hand, ink tank got more unit shipments this round. This was to offset the low ink tank shipment in 2021Q2. In total laser segment (including copier-based MFP), HP maintained its leadership by having 40.9% market share and YoY growth of 18.3% despite experiencing shortage of stocks. Fulfilment takes longer time and it is difficult to fulfil a sudden demand request or to participate in big projects.

“The shortages from spare parts and increase in logistics costs are expected to continue until the end of 2022, impacting printer supplies. As schools and offices continue to open, laser and inkjet printers demand will continue to show recovery despite stock shortages. Overall, the home/office printer market will show optimistic growth as the economy recovers due to better pandemic response. However, this will still be dependent on the developments like new variant, vaccination rate, and digitisation trends,” said Rivaldi.