Sunset review confirms five-year extension on Chinese, Taiwanese and Malaysian imports.

India has extended anti-dumping duties on black toner in powder form from China, Taiwan and Malaysia until 10 August 2030, following a detailed sunset review by the Directorate General of Trade Remedies (DGTR).

The move confirms the continuation of tariffs first introduced in August 2020 after an investigation found dumping practices were causing material injury to Indian manufacturers. The renewed measures, announced in May 2025, maintain the existing duty levels, which range between $1167 and $1568 per metric tonne (approx. €1,080–€1,450 / £910–£1,225), depending on the country and producer involved.

| Country | Exporter | Duty (US$/MT) |

| China | Trend Tone Imaging Inc. | 1,167 |

| China | All others | 1,568 |

| Taiwan | Trend Tone Imaging Inc. | 1,167 |

| Taiwan | All others | 1,568 |

| Malaysia | All exporters |

1,568 |

Source: DGTR Sunset Review Report, May 2025

The product under consideration is limited to black toner in powder form, used primarily in laser printers and photocopiers. The DGTR report reiterates exclusions for colour toner, MICR toner, OEM toner, liquid toner, and toner already loaded into cartridges.

The latest review (Case No. ADD-AD(SSR)-04/2024) covers the period from 1 April 2023 to 31 March 2024 and considered data from the past four financial years. The applicants—Indian Toners & Developers Ltd and Pure Toners and Developers Pvt Ltd—were accepted as representing the entire Indian production of the subject goods.

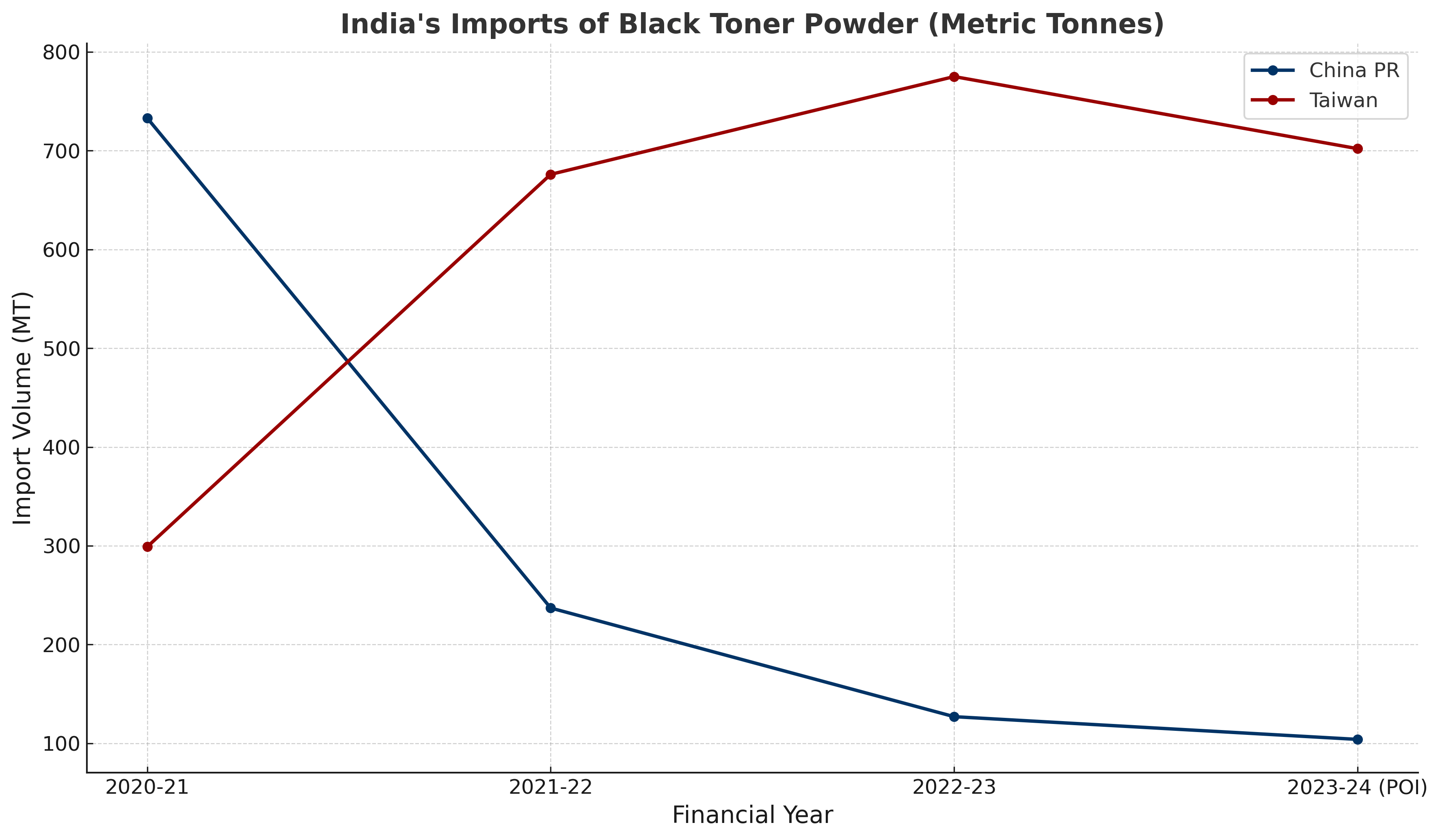

According to the DGTR, while total imports from the three countries fell by 15% during the investigation period, imports from Taiwan rose sharply, from 299 metric tonnes in 2020–21 to 702 MT in the most recent period—an increase of around 135%. In contrast, Chinese imports fell by 86% over the same period. Malaysia showed no significant exports.

Imports from Taiwan rose by 135%, while Chinese imports fell by 86%

(Graphic shared by our India reporter, May 2025)

Domestic sales of Indian-produced toner increased by 69%, and export sales rose by 52%, suggesting market recovery. However, the DGTR warned that “the domestic industry’s performance has deteriorated” and highlighted significant undercutting and surplus capacity in China and Taiwan as ongoing threats.

The review noted that the Indian market remains attractive, with evidence that exporters offer lower prices to third countries than to India. The DGTR stated there is a risk that Chinese products may be routed via Taiwan to circumvent duties and that surplus capacity could lead to renewed dumping if tariffs are removed.

In its defence, the domestic industry pointed to increased investment, higher capacity utilisation, and growing export markets—but said these gains would be jeopardised without continued protection. The DGTR agreed, stating the removal of duties “may lead to closure of the factory” and a “loss of investment.”

The anti-dumping measures apply only to bulk black toner in powder form. As reported by The Recycler in 2020, these duties were initially imposed to counteract heavily discounted imports, particularly from China. A subsequent update in 2021 highlighted further enforcement measures, including greater scrutiny of import declarations and mislabelling.

The latest ruling reaffirms India’s commitment to shielding its domestic toner manufacturing sector, largely made up of MSMEs, from below-cost imports. The decision also sends a message to global exporters that India will continue to use trade remedies to defend its industrial base from unfair pricing practices.