Thailand’s inkjet market continues to be dominated by ink tanks with growing acceptance in major verticals such as healthcare within the small and medium business (SMB) market.

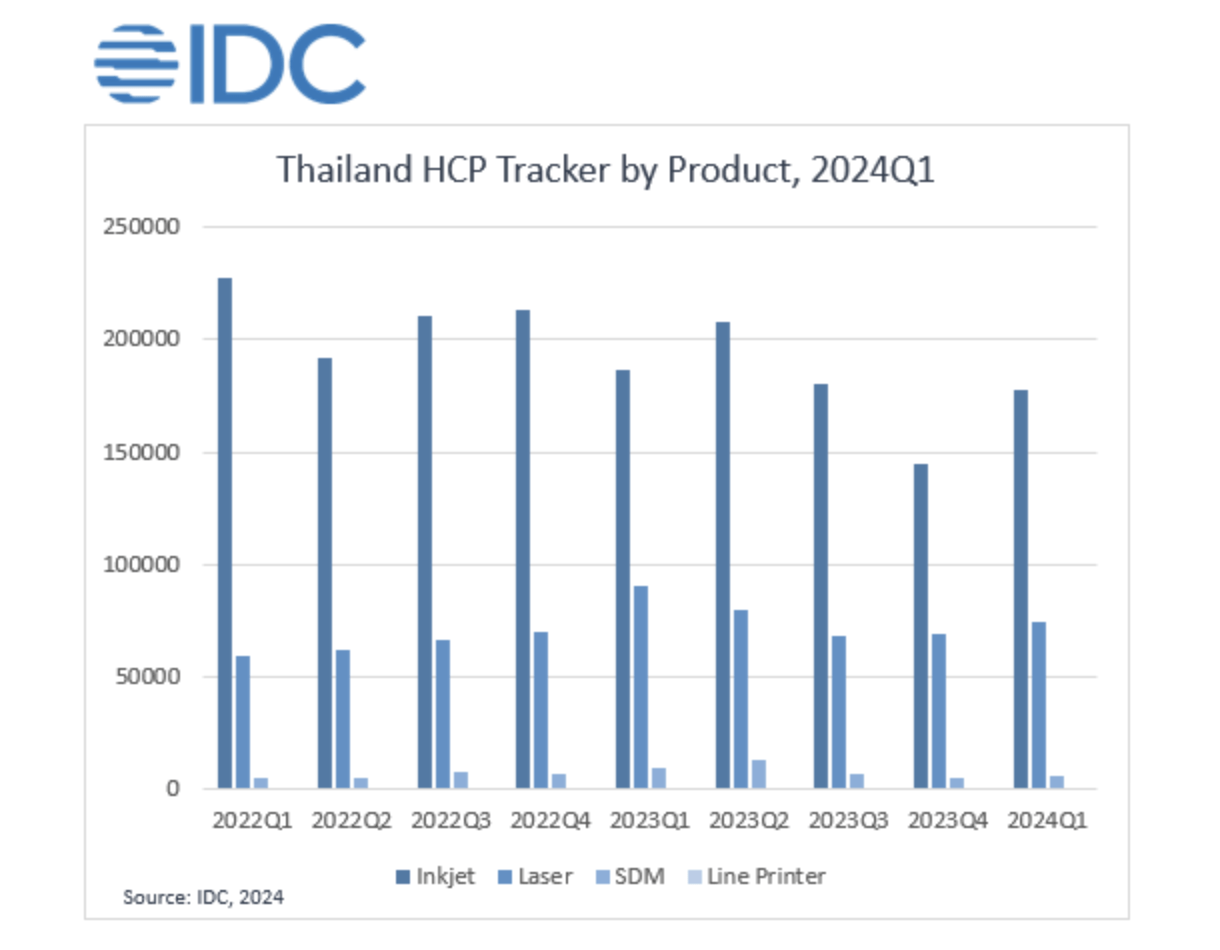

The IDC Worldwide Quarterly Hardcopy Peripherals Tracker reports that the HCP market in Thailand saw a 9.9% year-on-year (YoY) drop in 1Q24, with 258,035 units shipped across all products including inkjet, laser, and serial dot matrix (SDM). However, it still posted a Quarter-on-Quarter (QoQ) growth of 17.8% from 4Q23.

The year-on-year decline is attributed to the market’s recovery from previous shortage issues in 2023 and uncertainty caused by the unclear direction of the new government, leading to reduced spending from both consumer and commercial sectors. Breaking down the YoY performance by product type:

- Inkjet declined by 5.0%;

- Laser devices, including A4 and A3 machines, declined by 17.5%; and

- Serial Dot Matrix (SDM) declined by 33.1%.

While colour printing remains the top priority for ink tanks, sustainability concerns are also increasing. YoY performance has shown a decline of 1.6% for ink tanks and a 19.4% decline for ink cartridges, signalling ink cartridges continue to be replaced.

On the laser side, both laser A3 and A4 faced declines, with the A3 market declining by 6.7% YoY and the A4 market declining by 18.8% YoY. This was largely due to cautious spending from the consumer and commercial sectors stemming from uncertainty about the new government direction. In addition, the new government’s delayed budget spending has further lessened the demand that was supposed to come from the government sector.

“Although the overall HCP market faces YoY decline, we anticipate that the demand will recover in the short run as government and business spending will pick up again once the policies are finalised together with continual economic recovery,” said Paramat Arbhasi, Market Analyst, IDC Asia Pacific.

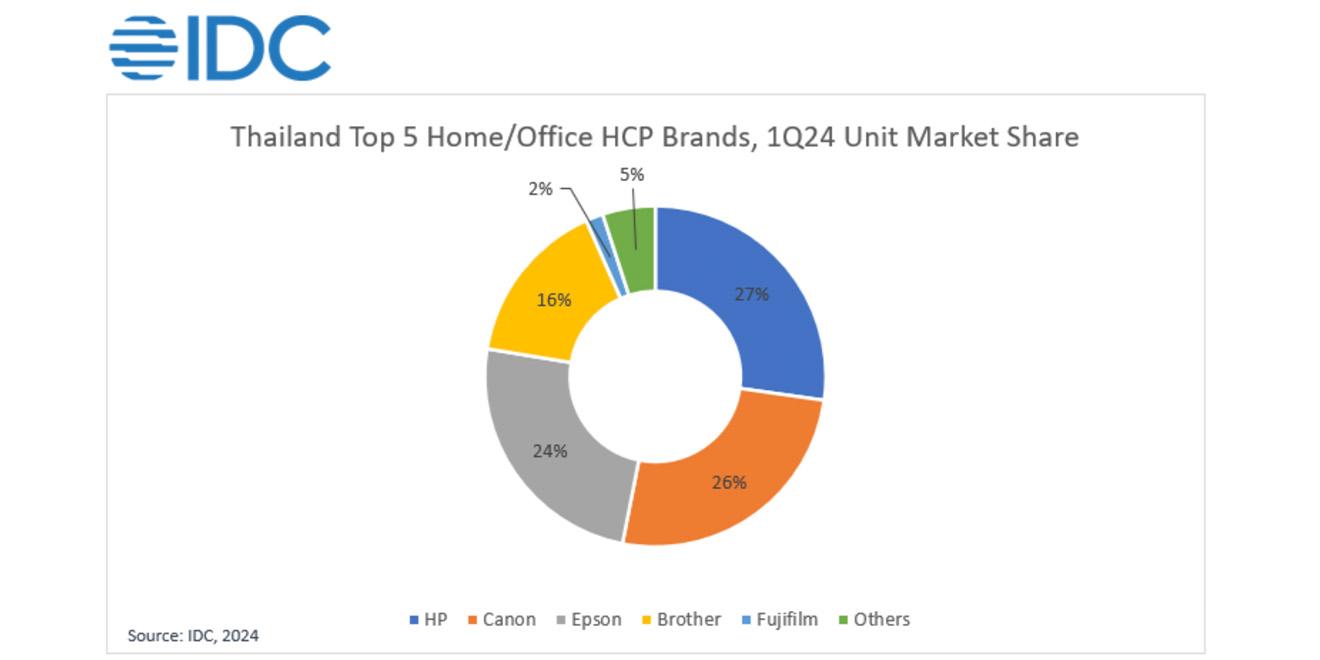

Top three home/office printer brand highlights:

- HP emerged as the market leader in 1Q24. The shifting focus toward ink tank and the recovery of its low-end mono laser printer has resulted positively.

- Canon came in second place. Similar to HP, the boost is due to low-end mono laser printers mostly from ongoing demand of consumers, SOHOs, and SMBs.

- Epson ranked third. The brand remains strong with its sustainability motto, helping it to pave the way for penetrating the healthcare sector.

“In line with IDC’s prediction, we see a softening demand in 2024 but retaining the growth as political situation has stabilised. Looking ahead, we anticipated an overall rebound from continual return in investment, both in the commercial and government sector,” ended Paramat Arbhasil, Market Analyst, IDC Asia Pacific.