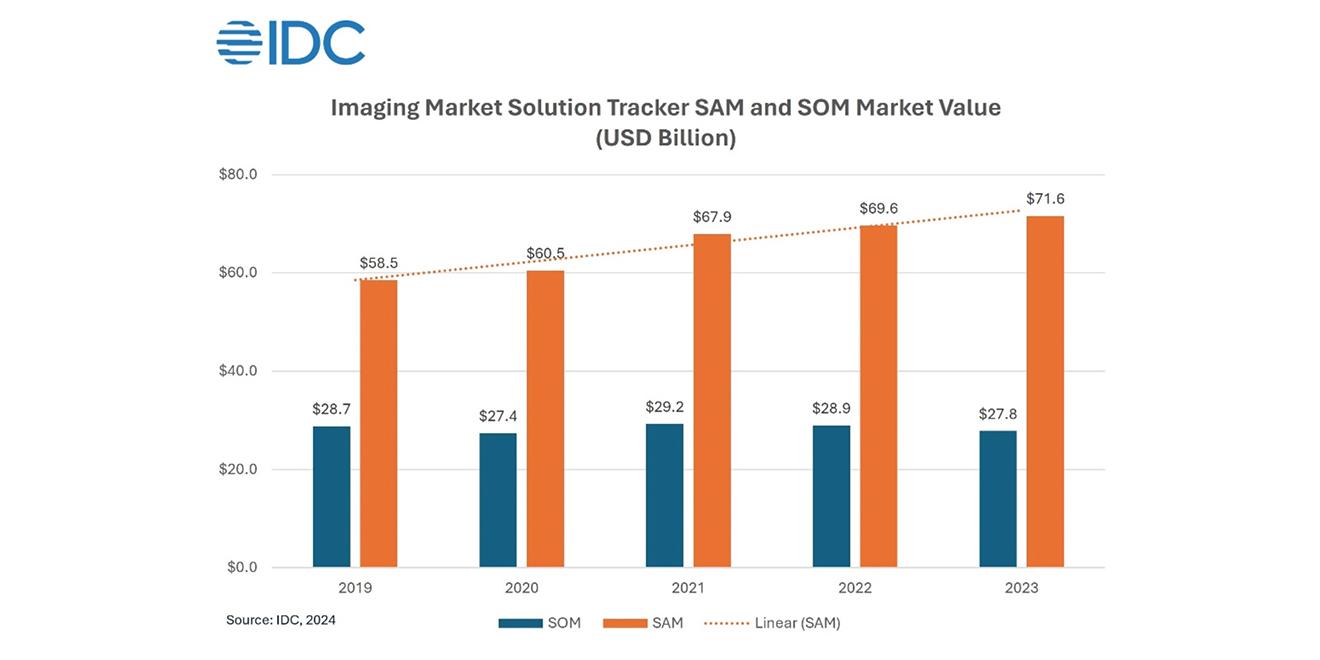

The Asia/Pacific imaging solutions market expands to $71.6 billion (€66.33 billion) in 2023, while vendor shares remain stable, according to IDC.

According to International Data Corporation’s (IDC) newly released Asia/Pacific Semiannual Imaging Market Solutions Tracker, the APeJ Serviceable Available Market (SAM) market for Imaging Vendor grew from $58.5 billion (€54.2 billion) in 2019 to $71.6 billion (€66.33 billion) 2023 with a positive 4-year CAGR of 5.2%.

Under the SAM category, IDC has categorised several markets across the hardware, software, and services spaces representing market expansion opportunities for imaging vendors. Vendors have already made in-roads in markets such as collaborative applications, content workflow and management applications, and Eenterprise resource management (ERM) applications which saw an average positive CAGR of 17.6%.

However, IDC identifies market segments such as Robotic Process Automation Software, Artificial Intelligence Software Services, and Security Software as prime areas for expansion. Comparatively, these markets are leading the SAM category with a strong positive 4-year CAGR of 37.2% on average. Conversely, the Serviceable Obtainable Market (SOM) category for vendors, which includes Hardware and Supplies market segments, sees declines over the same period as workflows become digital.

However, IDC identifies market segments such as Robotic Process Automation Software, Artificial Intelligence Software Services, and Security Software as prime areas for expansion. Comparatively, these markets are leading the SAM category with a strong positive 4-year CAGR of 37.2% on average. Conversely, the Serviceable Obtainable Market (SOM) category for vendors, which includes Hardware and Supplies market segments, sees declines over the same period as workflows become digital.

“User choices are no longer confined to the cost performance of hardware alone. Instead, requirements are evolving, as users view their relationships with imaging vendors more as partnerships to address their office or business needs,” said Jimmy ErSheng Li, Research Manager, Imaging Domain, IDC

“This shift of workflows becoming increasingly digital provides a strong growth trajectory for Software and Services in the serviceable available market. Such a trend underscores the diversification of conventional vendors’ product offerings beyond hardware towards total office solutions,” ended Li.

Imaging vendors gain a competitive edge by leveraging their understanding of traditional document workflows to introduce digital solutions that improve efficiency, agility, and cost-effectiveness. As a result, IDC anticipates that to meet diversifying business needs, vendors will have to continue expanding their solutions portfolios.

The Semiannual Imaging Market Solutions Tracker is now live on IDC’s Data & Analytics Query Tool platform.