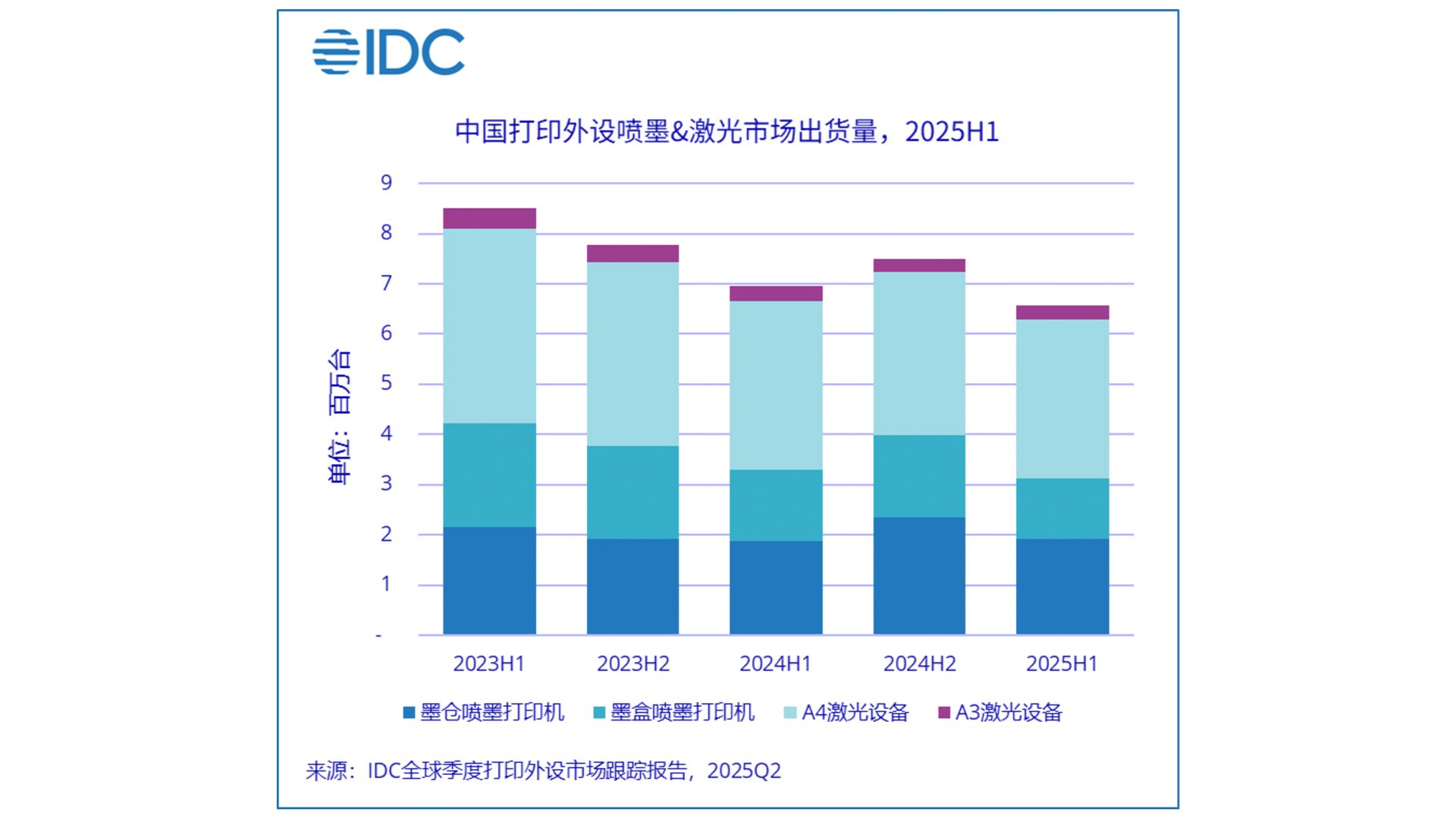

International Data Corporation (IDC) recently released the “China Print Peripheral Market Quarterly Tracking Report (2025 Second Quarter)”, which shows that in the first half of 2025, the total shipments of inkjet and laser products in China’s printing peripheral market were 6.564 million units, down 5.5% year-on-year.

Among them, the shipments of inkjet printing products were 3.115 million units, down 5.6% year-on-year; A4 laser equipment shipments were 3.177 million units, down 5.0% year-on-year; A3 laser equipment shipments were 272,000 units, down 10.0% year-on-year.

Although the state has implemented policies such as “national supplement” and hopes to stimulate the market’s demand to pick up, from the market reaction, the rebound in purchasing power is not obvious, and the overall market continues to decline.

In the first half of 2025, the inkjet printer market fell by 5.5% year-on-year, of which ink cartridge inkjet products fell by 16.4% year-on-year, and inkjet products increased by 2.6% year-on-year, becoming one of the few positive growth product lines in printed peripheral products. On the one hand, due to the steady increase in the demand from the household market, the retention rate of printers in China’s household groups still has a certain amount of room for growth compared with developed countries, and the replacement demand of student groups has also led to the purchase of household users.

On the other hand, more and more commercial users have begun to turn to inkjet printers rather than simply choose laser products, especially in the purchase group of inkjet printers. Mainly because the number of single devices has declined before, and more and more users are more concerned about the cost of singles, rather than printer speed.

In the first half of 2025, A4 format laser products fell by 5.5% year-on-year, of which A4 black and white laser printers decreased by 5.2% year-on-year, and A4 colour laser printers decreased by 2.2% year-on-year. A3 format laser products fell 10.0% year-on-year, of which A3 black and white laser products fell 2.8% year-on-year, A3 colour laser products decreased by 19.7% year-on-year.

IDC said that during the economic environment, small and medium-sized enterprise users pay more attention to the operating costs of enterprises and reduce budget expenditure, so the purchase demand for the overall A4 laser products has declined year-on-year, while large and medium-sized enterprises and government users have also continued to tighten their budgets in the first half of this year. More and more domestic brands have joined the market, especially the A4 laser market, making the overall market more fierce competition, and the average price of the market has also declined.

A3 laser equipment market shipments fell significantly, more and more customers tightened their budgets, extended machine use and service life, resulting in the market of new installed capacity shipments decline. In addition, second-hand equipment such as regenerative machines and refurbished machines also occupy a certain market share in the market, which has affected the sales of new machine equipment to a certain extent.

Wang Shana, Senior Research Manager of IDC China’s printing, imaging and document solutions research department, believes that the overall market demand for printer peripheral hardware devices in China will not improve significantly in 2025. The direction of the development of foreign markets will further accelerate the transformation and migration to service and software solutions. At the same time, the competitive landscape of the market will be more challenging, and the competition from various brand camps will become more and more obvious.

Shana explained that the decline in overall printing volume is the fundamental factor leading to the decline in the installed capacity of hardware equipment in the market, so the demand for document management and digital upgrading has become more important.