International Data Corporation (IDC) data shows that the total investment scale of the global ICT market in 2023 will be close to US$4.9 trillion (€4.42 trillion), and is expected to increase to US$6.6 trillion (€5.9 6 trillion) in 2028, with a five-year compound growth rate (CAGR) of 6.3%.

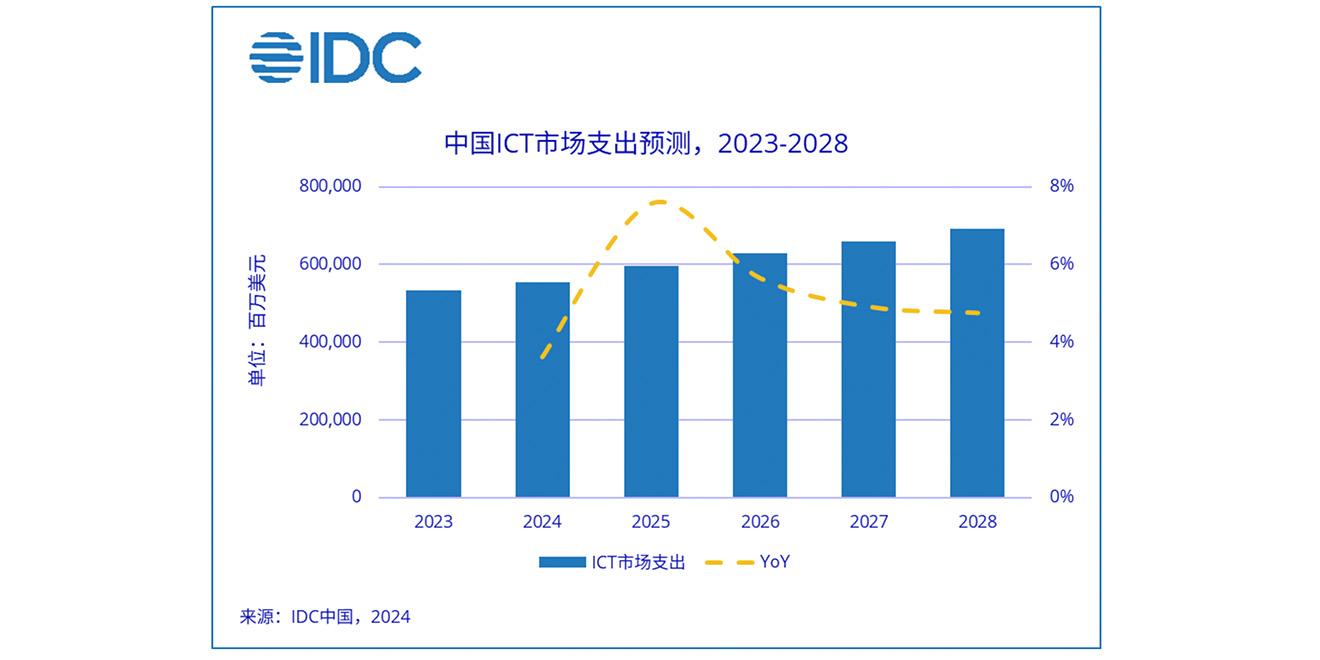

IDC predicts that China’s ICT market size will be close to US$691.59 billion (€624.68 billion) in 2028, with a five-year compound growth rate (CAGR) of 5.1%. Among them, the consumer side has been affected by the epidemic and geopolitics, and its growth rate has slowed down in the past few years. In 2024, the end market will bottom out and the growth rate will increase.

From an enterprise perspective, China’s enterprise-level ICT market size will be approximately US$248.78 billion (€224.7 billion) in 2024, an increase of 7.1% from 2023, which continues to be higher than the growth rate of GDP. China’s enterprise-level ICT market will grow at a compound growth rate of 9.0% per year from 2024, and the size of China’s enterprise-level ICT market will be close to US$360 billion (€325.16 billion) in 2028. IDC said that this is mainly due to the increasing investment by enterprises and organizations in areas such as artificial intelligence, cloud computing, and going overseas.

Generative artificial intelligence’s demand for computing power has also become a major driving force for the growth of the ICT market. Enterprises continue to increase investment in data storage and computing infrastructure to meet growing computing needs and support the development and application of generative AI technology. This trend further drives the overall expansion of the ICT market, especially in the areas of high-performance computing and cloud services. IDC predicts that China’s enterprise-class server and storage investment five-year compound growth rate (CAGR) will reach 10.2% from 2023 to 2028.

In addition, the proportion of cloud computing deployment models in the enterprise IT market will further increase and enterprise IT will gradually enter the all-cloud era. As enterprises’ demands for flexibility, scalability, and cost-effectiveness continue to increase, more and more enterprises are choosing to migrate core businesses and applications to the cloud to achieve more efficient resource management and faster innovation capabilities. IDC data shows that China’s IaaS spending growth continues to exceed the growth of other hardware spending, with a five-year compound growth rate (CAGR) of 15.6%.

Chinese public cloud manufacturers are actively expanding overseas markets, and market revenue in video, e-commerce, gaming and other industries has increased significantly. In addition to the traditional Southeast Asian and European markets, regions such as the Middle East and Latin America have gradually become new overseas hotspots.

Industry insights

The financial services industry remains the leading industry for ICT spending. With the further advancement of AI technology and digital transformation, financial institutions continue to increase investment in emerging technologies to enhance operational efficiency, optimize risk management and improve customer service quality.

In addition, the software and information services industry is also a major industry for ICT investment. IDC predicts that the software and information services industry will grow at a compound annual growth rate of 9.2% starting from 2024, and the investment scale in 2028 will be approximately US$50 billion (€45.16 billion).

Enterprise size insights

In 2024, Very Large Business (1,000+) will still be the main force in ICT spending, accounting for more than 20% of the investment share. IT spending by small and medium-sized enterprises continues to rise. With the development of AI technology, small and medium-sized enterprises are paying more and more attention to emerging technologies, enhancing their competitiveness and promoting enterprise development by accelerating digital transformation.