In a challenging Q3 2023 financial report, HP Inc. prioritises fiscal prudence as revenues continue to decline, highlighting its commitment to solid cash management in uncertain market conditions.

In its Q3 2023 financial report, HP Inc. (NYSE: HPQ) confronts ongoing revenue declines while highlighting resilience and adaptability. Despite revenue challenges, HP manages strong earnings per share and a focus on cash management.

Q3 2023 saw HP revenues slump to $13.2 billion (€2.151 billion), a concerning 9.9% year-over-year decrease in net revenue, which, when adjusted for constant currency, amounted to a 7.4% dip.

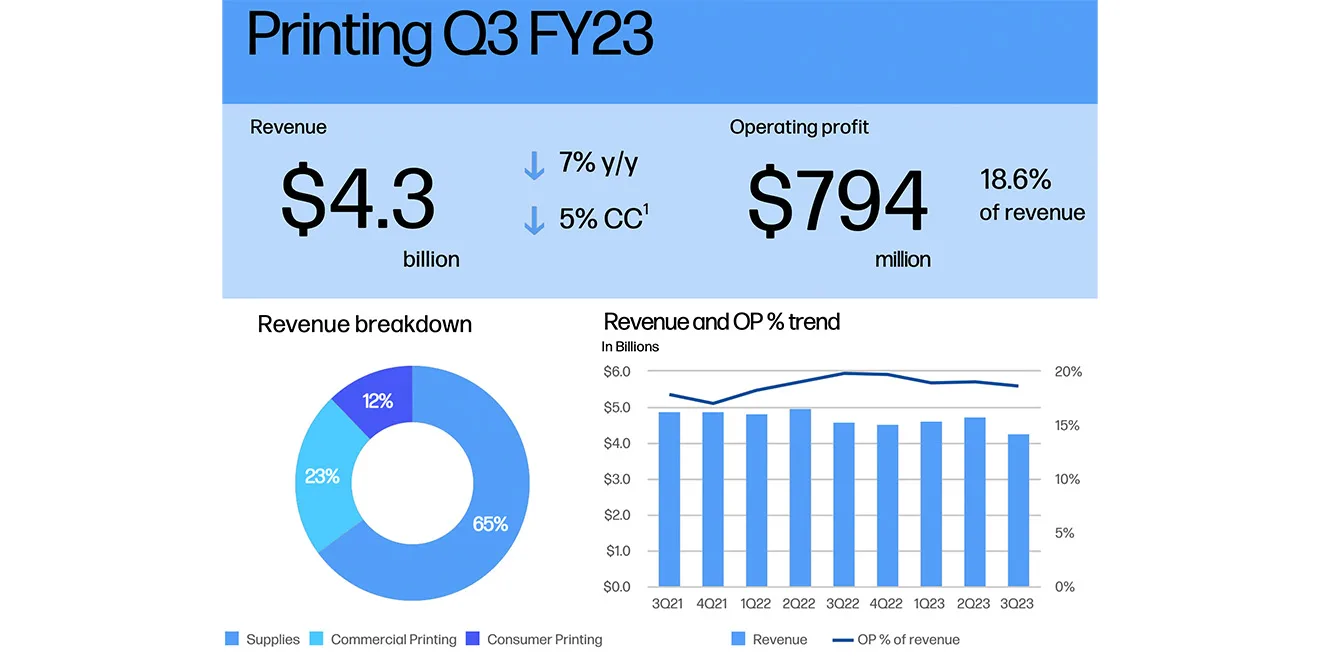

Segment-wise, the Printing division reported a 7% YoY decrease in net revenue to $4.3 billion (€3.958 billion) but maintained a robust 18.6% operating margin. Consumer Printing bore the brunt of the decline with a staggering 28% drop, whereas Commercial Printing experienced a 6% dip. Supplies net revenue also faced a 2% decline, though it remained stable when adjusted for constant currency.

In the Personal Systems sector, there was a notable 11% YoY drop in net revenue to $8.9 billion (€8.191 billion), with a 6.6% operating margin. With total unit sales up 3%.

On a more positive note, the tech giant generated $1.0 billion (€0.921 billion) in net cash from operating activities and boasting free cash flow of $0.9 billion (€0.89 billion) during the quarter. Despite the revenue decline, HP returned $0.3 billion (€0.276 billion) in dividends.

HP anticipates generating free cash flow of approximately $3.0 billion (€2.761 billion) for fiscal 2023.

HP’s CEO, Enrique Lores, expressed confidence in the company’s ability to drive long-term growth and value creation despite some challenges in the external environment. The report highlights HP’s focus on the printing sector and its efforts to maintain profitability in the face of changing market conditions.

Our take on this: While HP Inc. addresses its Q3 2023 financial report with a commitment to fiscal responsibility amid declining revenues, one cannot help but wonder if there’s a broader movement away from traditional printing practices and HP products. The revenue slump of 9.9%, which translates to a 7.4% dip when adjusted for currency fluctuations, signals market challenges and potentially shifting consumer preferences towards more sustainable alternatives and brands. As HP grapples with a significant 28% drop in consumer printing, it raises questions about whether consumers are actively seeking eco-friendly options in the era of environmental consciousness. As competitors and sustainable brands emerge, the tech giant might face a growing challenge in retaining its market share.