New 3D printer shipments continued to accelerate in Q2 2021 in both long-standing verticals, such as dental and aerospace, and new markets eager to explore technologies which can help mitigate current and future supply-chain hiccups, according to latest market insights by CONTEXT, the IT market intelligence company.

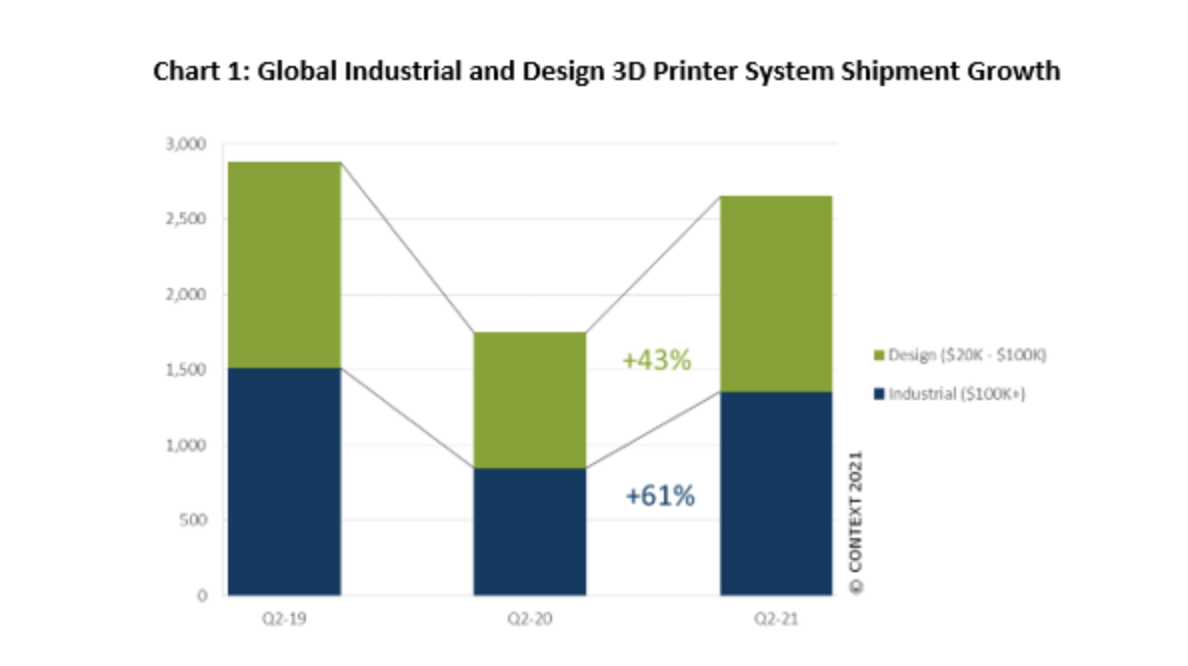

3D Shipments grew 61% and 43% for the most expensive types of printer on the market, those in the Industrial price class (costing more than $100,00 (€86,000) for a system) and Design class ($20,000–$100,000 (€17,000-€86,000)). Between them, these printers accounted for 64% of global system revenues over Q2 2021, and were also those most negatively impacted by Covid shutdowns.

“As economies around the globe continued to recover from, battled against or learned to live with Covid-19, organisations began to settle in to their new normal”, said Chris Connery, VP of Global Research at CONTEXT. “While capital expenditures were largely put on hold a year ago, spending had opened up by the second quarter of this year and this led to phenomenal year-on-year shipment growth rates.”

In spite of this phenomenal growth, shipments were not yet up to pre-Covid levels with those of Industrial printers being 10% down on Q2 2019 and those of Design printers 5% down. For the quarter, the increase in Industrial printer shipments was most significant in North America while new shipments in Western Europe only rose modestly and China shipments levelled off after super-acceleration in previous quarters. All but two of the Top-10 vendors of Industrial printers saw shipments rise from a year ago with notable exceptional organic shipment growth seen from UnionTech, Stratasys and 3D Systems.

In spite of this phenomenal growth, shipments were not yet up to pre-Covid levels with those of Industrial printers being 10% down on Q2 2019 and those of Design printers 5% down. For the quarter, the increase in Industrial printer shipments was most significant in North America while new shipments in Western Europe only rose modestly and China shipments levelled off after super-acceleration in previous quarters. All but two of the Top-10 vendors of Industrial printers saw shipments rise from a year ago with notable exceptional organic shipment growth seen from UnionTech, Stratasys and 3D Systems.

At the other end of the market, shipments of Personal and KIT&HOBBY printers went in the opposite direction. Demand from hobbyists locked at home meant there was fantastic growth in these classes during 2020 but sales are now waning: in Q2 2021 shipments of DIY printers were up 18% year-on-year, a level far below that seen in recent quarters, and shipments for fully-assembled printers costing less than $2,500 (€2,000) were down 32%. With no near-term demand catalyst for these consumer-centric models, many vendors have looked to add new types of printers to their portfolios. The hottest area at this low end of the market is resin-based LCD vat photopolymerisation printers which accounted for 46% of all shipments of fully assembled 3D printers over the quarter, up from just 10% in 2019 as a whole.

Professional price-class printer shipments were less impacted by Covid shutdowns last year than those of Industrial and Design models but demand had not been as robust as that for consumer-targeted printers. While some vendors saw growth a year ago as demand from at-home workers rose, others were affected by supply-chain disruptions and key end-markets shutting down. Although shipments now seem to have recovered from the pandemic (they were up 38% from Q2 2020 and even up 33% from Q2 2019) this is related more to the introduction of new products from leading vendors than to Covid-related changes in demand – most growth in the category is seen following rollouts. The new, larger form-factor, resin SLA printers from Formlabs have so far been very successful and the ramp-rate for the same company’s SLS polymer powder bed fusion machine is also encouraging. All of the Top 10 vendors saw year-on-year shipment growth in Q2 2021: besides Formlabs, the quarter was also particularly good for Stratasys, Markforged, Zortrax, UNIZ, 3D Systems and Desktop Metal (with most of their products in this price-class coming from their EnvisionTEC division).

“Companies, especially those based in the US and China, are increasingly bullish about prospects for growth in H2 2021 as in-person trade events begin again around the world”, added Connery. “This optimism needs to be tempered when it is based on marketing activities associated with new public listings, or have the nuances examined given that many individual companies are looking to grow by adding non-3D printing technologies to their portfolios. The outlook for the 3D-printer-only market is further clouded by the fact that individual companies have seen growth as a result of mergers and acquisitions. Even parsing out individual technology trends and focusing only on net-new 3D printer shipments, forecasts for 2021 are robust.”

CONTEXT’s expectation is that 2021 will not only see great year-on-year growth but also see shipments rise above 2019 levels: for example, industrial printer shipments are now forecast to be up 35% compared to 2020 and, more importantly, up 6% from 2019.