3D printer shipments in H2 2021 were limited by the advent of omicron and the very supply-chain woes the technology could help alleviate but the market is now poised for strong growth as interest and order rates accelerate, according to the latest research by CONTEXT.

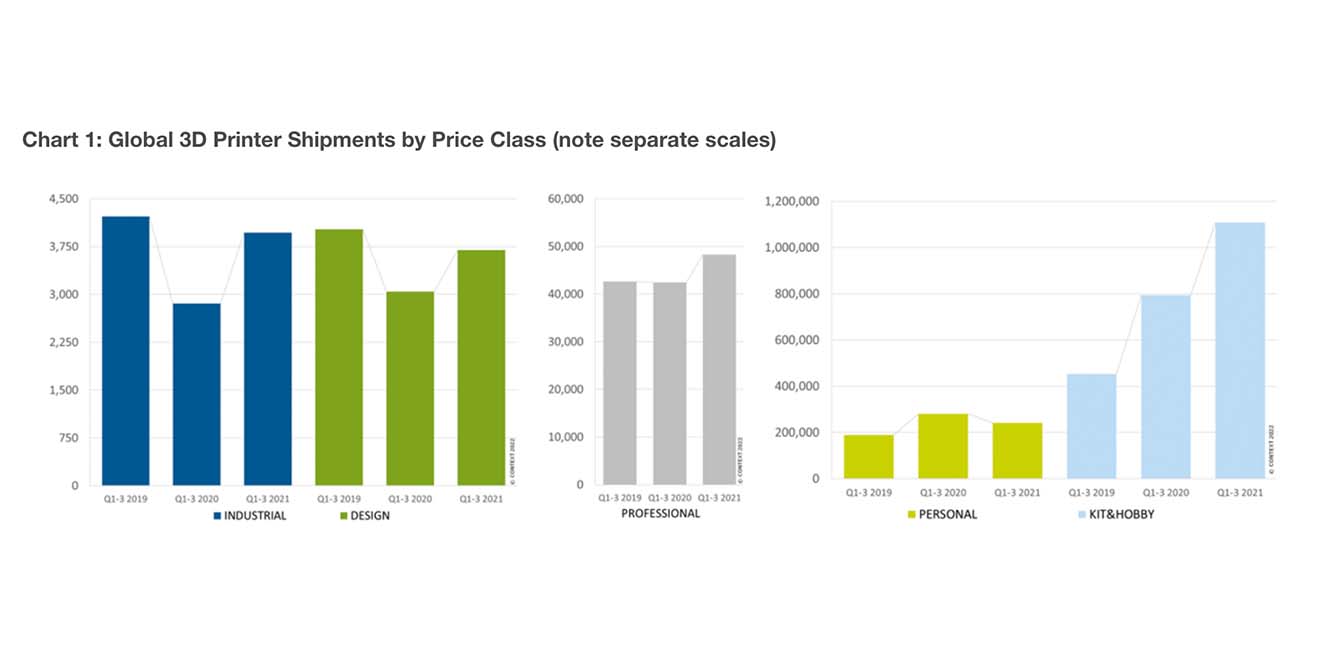

Shipments of industrial 3D printers were up 39% through the first three quarters of 2021 but remained recessed -6% from pre-Covid levels (Q1-Q3 2019). Certain 3D printing technologies can bring mid-volume production of hard goods closer to the point of consumption and so shorten the supply chain, reducing the dependence on logistics that are currently problematic across the globe.

However, not all components within 3D printers themselves can be made in this way and the industry was plagued with its own supply-chain challenges in Q3 2021. Shipments of new high-end printers grew over the quarter but vendors were not yet able to fire on all cylinders and many reported that demand outpaced supply. Enthusiasm was palpable at recent in-person trade events (RAPID+TCT in the US in September and Formnext in Germany in November) where would-be customers were once again able to see people and products in ‘real life’.

Almost all major vendors at Formnext said that new and renewed interest in 3D printing was a consequence of global supply-chain problems. The interest is not merely anecdotal but has been carried through into order books, leaving the industry buoyant. Demand for consumer-targeted printers has waned since initial lockdowns but remained higher than pre-pandemic levels over the first three quarters of 2021.

Shipments of industrial- and design-class printers (those selling for $20,000+ (€17,724)) rebounded strongly in 2021 after being severely impacted by reduced capital expenditure by businesses across the world in 2020. Even so, the number of new printers sold lagged behind pre-Covid levels. Strongest demand in the industrial 3D printer category in the period was seen from printers focused on production or on mass customisation. Shipments of machines utilising some technologies was even above 2019 levels: Up 22% for polymer Vat Polymerisation printers and up 104% for metal Binder Jetting models. The latter type of printer is used by a myriad of markets (including luxury goods, education, R&D, and the automotive and aerospace industries) for mass production. Resin Vat Polymerisation printers remain heavily in demand from the dental industry across the globe: the ever-accelerating production of clear dental aligners is an example of the use of 3D printers for mass customisation, creating many products, each of which are slightly different.

The ”professional” price class was the least impacted by the pandemic and the relatively high 2020 baseline makes its 14% year-on-year growth in the first three quarters of 2021 look less impressive. However, shipments were up not only on the previous year but also 13% higher than in the same period pre-Covid. Recent growth in this sector has been driven by new product lines and the accelerating introduction of benchtop SLS polymer Powder Bed Fusion machines.

Fully assembled Personal 3D printers have continued to give way to lower-priced kits, even though demand for both skyrocketed at the height of Covid lockdowns in 2020. demand at this lower end of the market waned as markets returned to a new normal in 2021, but shipments remained above 2019 levels. As these categories are consumer-focused, the fourth quarter is the most telling and current projections suggest that annual shipments of Personal printers could be down by as much as 10% on 2020 although still up 33% up on 2019. Kit & Hobby printer shipments are on track to see growth of at least 36% year-on-year, which sounds great but many vendors had higher expectations given that 2020 sales were almost double those of 2019. The hottest items in this hobbyist-centric market are resin-based LCD printers, many of which sell for below $250 (€222).

CONTEXT concluded that during 2022, areas of focus for the industry will include high-temperature material extrusion thermoplastics, composites, the balance between organic growth and consolidation, supply-chain mitigation, and the role of digital manufacturing alongside that of additive manufacturing. The current record backlog looks set to push aggregate system revenues for 2022 up 23% on 2021. Forecasting over a 5-year period, the projection is that technologies poised to push further into mass production (for example, metal Binder Jetting, polymer Vat Photopolymerization and polymer Powder Bed Fusion) will see a CAGR of 30% or more in unit volumes.