Western Europe’s distributors sold an unprecedented number of ink-tank printers in the second quarter of 2020, according to the latest data published by CONTEXT, the IT market intelligence company.

CONTEXT said the increase reflects the continued growth of a technology that is relatively new in Europe. Marketed as a smart investment that delivers long-term savings, ink-tank printers appeal to users wishing to equip their homes with durable hardware. Control measures associated with the COVID-19 pandemic have, therefore, created conditions that favour adoption of these devices.

Price increases resulting from a shortage of traditional consumer inkjet printers, and shortages of ink cartridges, have also encouraged uptake of ink-tank models, according to CONTEXT.

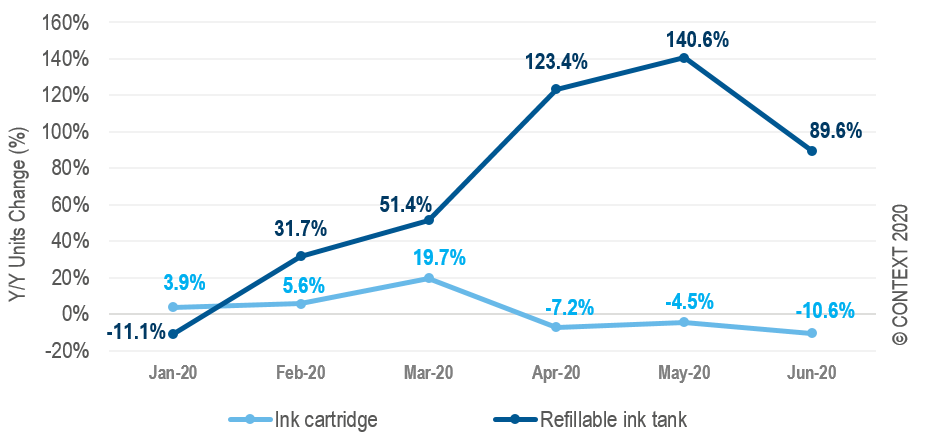

The steadily increasing market share and the strong upward month-by-month sales trend suggest that ink-tank printers may well end the year with a higher share than last year’s 4.9%. In the second quarter of 2020, the number of traditional ink-cartridge printers sold fell year-on-year while ink-tank sales saw dramatic increases.

Ink-tank printers accounted for 6.6% of sales of inkjet units sold in Western Europe in the first half of 2020 (up 2.3 pts compared to the same period last year), and for 15.7% of inkjet revenue, with sales of ink-tank printers through the distribution channel increasing by 59.8%. This overall figure disguises the details of the trend: unit sales climbed throughout the spring, with year-on-year growth rates climbing from -11.1% in January to +89.6% in June, CONTEXT said.

The year-on-year performance of ink-tank printers in the major Western European markets exploded in the second quarter, coinciding with lockdowns. In the first quarter, the number of units sold in Germany was down by 30.3% on the previous year; in the second quarter they were up by 110.7%. In the UK, they moved from 19.4% in the first quarter to 142.5% in the second; and in Italy from 69.5% to 149.3%. There was also a change in unit sales in France from -14.9% to +70.3%.

According to CONTEXT, the geographical spread of ink-tank printer sales in Western Europe largely follows the size of the market in each country with four of the Top 5 heading the list. Germany took 25.2% of ink-tank sales, representing a fall from its even bigger share of 36.2% in the first six months of 2019. Italy followed with 19.3%; the UK took 13.7%; and Spain 11.2%. Whilst the UK’s share held steady, Italy and Spain both increased their shares compared with the same period last year. France took only 2.7% of sales compared with 3.7% in the first half of 2019 – a smaller share than the other major countries in both years.

The mix of brands is steadily diversifying as more vendors explore Europe’s potential, CONTEXT explained. Epson, an early champion of the technology, took 79.2% of the market in the first half of 2020; 24.1% of its inkjet units were ink-tank models, and they provided 41% of its revenues for the category. Other major vendors are making inroads: HP’s and Canon’s shares of the ink-tank market increased in H1 2020 compared with the first half of 2019 (8.8% and 5.9% share respectively).

Context concluded that although the pandemic has encouraged uptake, there are other positive indicators – a diversifying share of the market across countries and across vendors – suggesting that ink-tank models are poised to steadily replace traditional consumer inkjet printers in Western Europe.

Tags: CONTEXT, Market Research, Ink Tank, Printers