According to the new Worldwide Black Book Live Edition published by International Data Corporation (IDC), the European ICT market is expected to grow year-on-year by 4.1% in 2022 in constant currency terms.

In current annual value, the market will decrease year on year by 3.2% in 2022, due to exchange rate fluctuations, including the continuous drop of the euro against the U.S. dollar. This currency value drop was due to the Russia/Ukraine war, which is negatively impacting the overall eurozone economy, with increased prices for oil, gas, and food, as well as suspended natural gas supply from Russia. Growing inflation, supply chain constraints, and geopolitical conflicts will also negatively affect the European PC and tablet markets, which will inhibit overall ICT spending in the region.

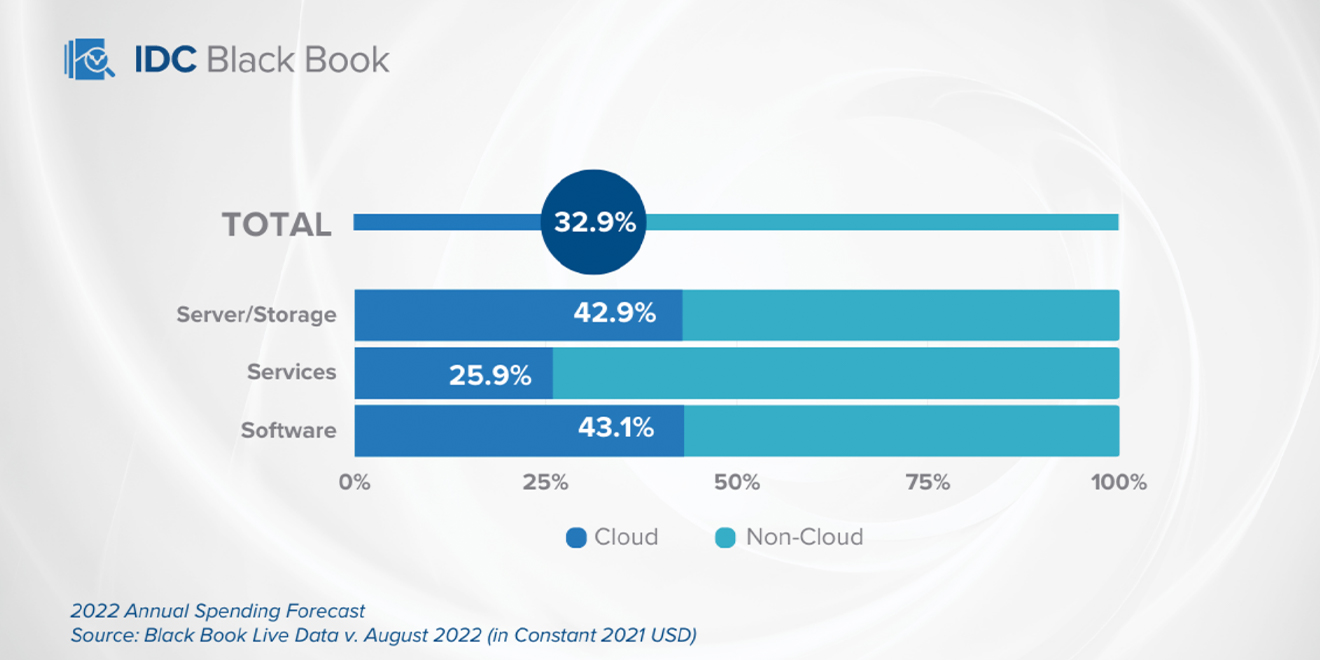

In contrast, despite the unfavourable macroeconomic environment, spending on software and security hardware in Europe is expected to stay relatively stable over the next few years. Cloud has emerged as a key technology for helping organizations increase their resiliency, and the latest version of the Black Book Live now includes a cloud spending view of the market. Overall cloud-related spending in Europe is forecast to constitute almost one-third of total technology spending in 2022, and its share will keep increasing over the next five years.

Almost 43% of the total spending on server and storage markets in Europe in 2022 is expected to be focused on cloud enablement; according to IDC this figure will grow rapidly in the next few years, making up half of this infrastructure spending by 2024. Many companies will continue to invest in modernisation of their infrastructure, which entails an accelerated shift to cloud in order to make IT budgets more stable and ensure business continuity, especially in periods of recession or disruption.

Software spending in Europe is expected to stay more or less stable over the coming five years, as organisations rely on software to support their digital transformation initiatives. Investments in cloud software will exceed 40% of total software spending and post a double-digit growth rate to surpass non-cloud software spending in 2024. Cloud migration will become a priority for organisations, with a focus on AI platforms, collaborating applications, and security solutions, and cloud-related spending will surpass spending on traditional software deployment in one to two years.

Many IT services providers will continue to expand the scope of their cloud professional services and managed cloud services, including planning, deployment, implementation, and management of cloud environments in order to assist customers at any stage of their cloud journey. This will drive cloud-oriented services spending to exceed 25% of the total services spending in Europe in 2022. Cloud-related services spending in Europe will record a growth rate between 16% and 19%. over the next five years.

“European companies are considering cloud adoption to help them overcome the disruptive effects of the worsening economic and geopolitical situation,” said Lubomir Dimitrov, Research Manager for IDC European Data & Analytics. “Business continuity, security, and disaster recovery plans will be the main focus of cloud deployments.”