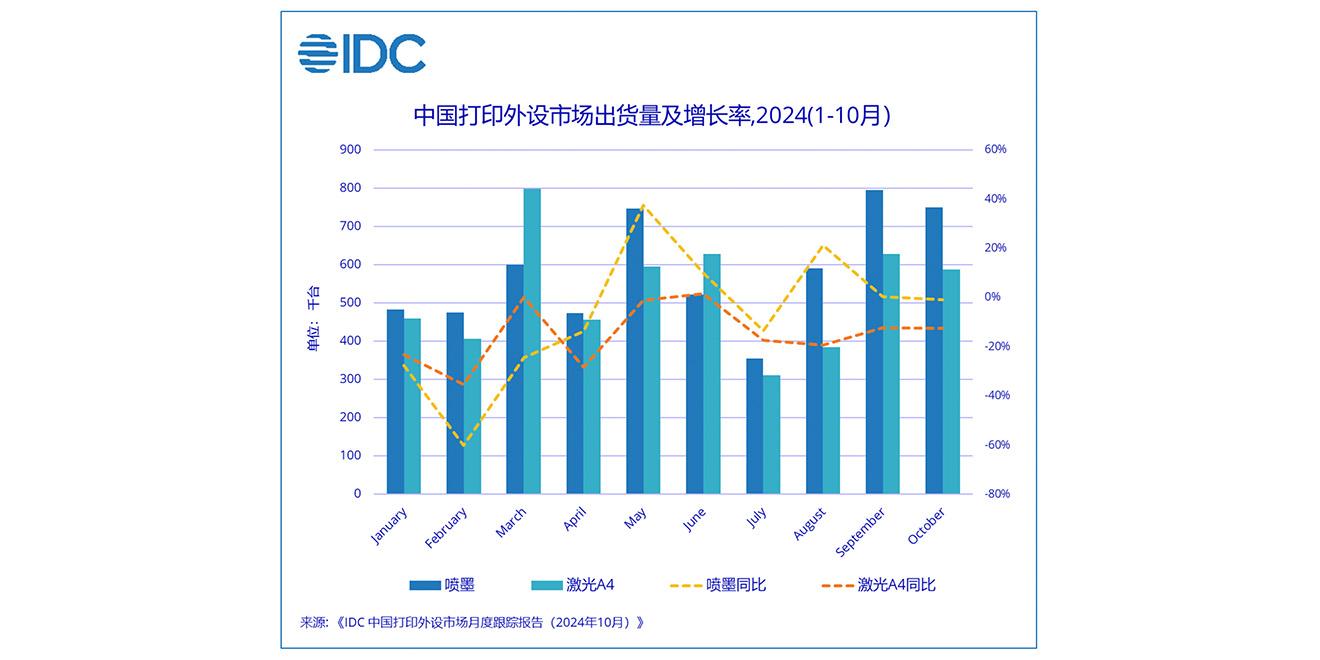

The latest “China Printing Peripheral Market Monthly Tracking Report (October 2024)” released by International Data Corporation (IDC) shows that as of October 2024, China’s printing peripheral market shipment volume (excluding A3 laser) was 11.046 million units, a year-on-year decrease of 13.6%.

Among them, the shipment volume of inkjet printers was 5.791 million units, a year-on-year decrease of 13.1%; the shipment volume of laser A4 printers was 5.254 million units, a year-on-year decrease of 14.2%.

IDC said that the economy continues to be in a downward cycle, and the downgrade of user consumption is the main reason for the sharp year-on-year decline in shipments this year. IDC believes that the demand for inkjet will increase slightly year-on-year starting from the second quarter of 2024, and the demand for inkjet during the school season will be higher than expected.

IDC said that the economy continues to be in a downward cycle, and the downgrade of user consumption is the main reason for the sharp year-on-year decline in shipments this year. IDC believes that the demand for inkjet will increase slightly year-on-year starting from the second quarter of 2024, and the demand for inkjet during the school season will be higher than expected.

From January to October 2024, inkjet printers fell by 13.1% year-on-year, of which ink cartridge printers fell by 27.2% year-on-year, and ink tank printers increased by 0.7% year-on-year.

The prices of entry-level ink tank products continue to decline, and the proportion of products priced below $100 (€95.03) is increasing rapidly. The price-performance ratio of the ink cartridges has been reduced, and more users choose to buy original ink cartridge products, causing the market demand for ink cartridge products to decline rapidly. Mainstream manufacturers have also launched a variety of commercial inkjet products in 2024, and the acceptance of inkjet in the commercial market is gradually increasing.

The economic recovery is not as good as expected, some small and medium-sized enterprises are struggling to survive, and the market demand for laser A4 has declined significantly.

From January to October 2024, A4 format laser printers fell by 14.2% year-on-year, of which A4 black and white laser printers fell by 15.2% year-on-year, and A4 colour laser printers increased by 1.7% year-on -year. Competition between domestic and foreign manufacturers has intensified, and the prices of mid- to low-end products have continued to decline. Multi-functional all-in-one machines with double-sided printing, direct Wi-Fi connection, and mobile printing functions are favoured by more users, IDC said.

The shipment volume of A4 colour machines has increased slightly against the trend. On the one hand, it has a fixed user group, which is less sensitive to price. On the other hand, it has benefited from the investment of domestic brands in the colour A4 market and launched a variety of cost-effective models.

Cheng Yana, Senior Analyst at IDC China’s Printing, Imaging and Document Solutions Research Department , believes that in the fourth quarter of 2024, driven by promotions and the national subsidy trade-in policy, consumer market demand will be released in advance, but commercial market demand is still sluggish. The printing peripheral market will show a year-on-year downward trend in 2024. Affected by macroeconomic and trade policies in 2025, there is still great uncertainty in demand recovery.

For printer manufacturers, deepening market insights during the market downturn, enriching machine category layout, optimising applications in different scenarios, in-depth cooperation with system integrators, and using AI functions to improve user experience are all effective opportunities to improve their competitiveness.