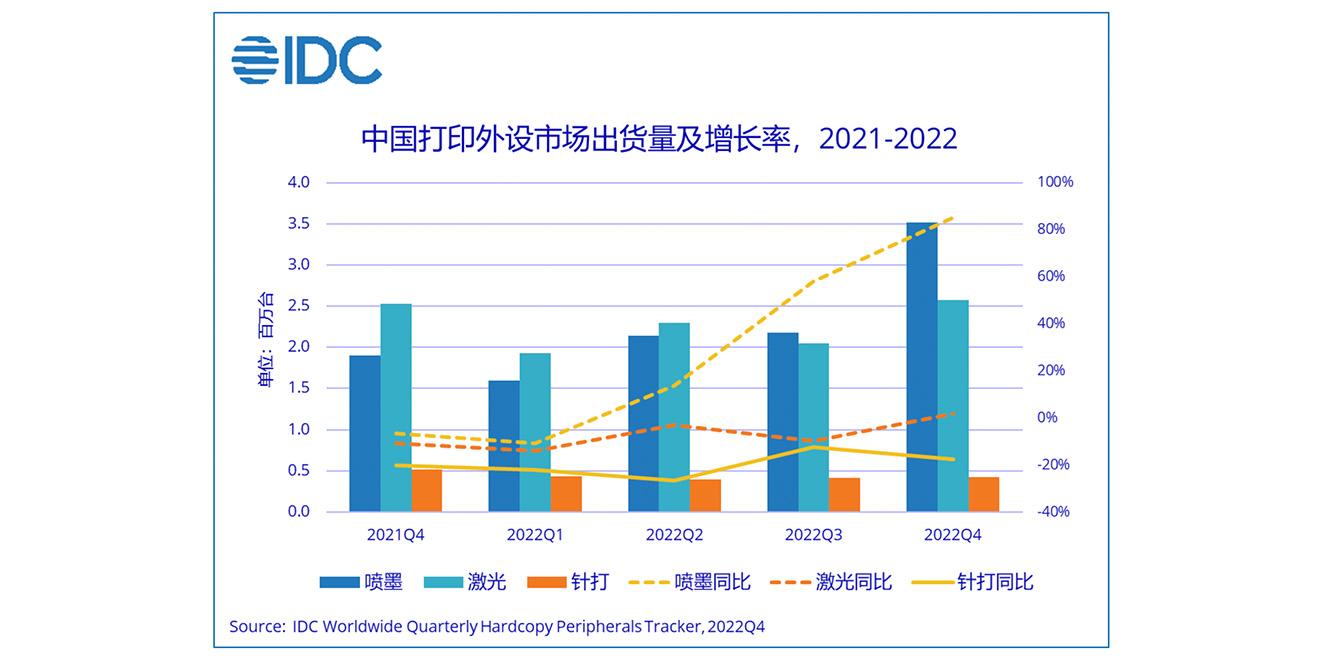

IDC’s latest “China Printing Peripherals Market Quarterly Tracking Report (Q4 2022)” shows that in the fourth quarter of 2022, China’s printing peripherals market shipped 6.511 million units, a year-on-year increase 7% of-year.

The shipment of inkjet printers were 3.513 million units, a year-on-year increase of 85.1%; laser printer shipments were 2.575 million units, a year-on-year increase of 1.7%; the shipment of dot matrix printers were 422,000 units, a year-on-year decrease of 17.6%.

In 2022, the total shipment volume of China’s HCP market will be 19.961 million units, a year-on-year increase of 8.2%.

2022 is a year of complex fluctuations, IDC said. Frequent epidemics have led to the closure of cities in many places, which has seriously affected factory production and logistics transportation, and the supply of printers has fluctuated. Economic development is hindered, business operations are difficult, government budgets are reduced, and procurement demand in the commercial market has shrunk significantly.

2022 is a year of complex fluctuations, IDC said. Frequent epidemics have led to the closure of cities in many places, which has seriously affected factory production and logistics transportation, and the supply of printers has fluctuated. Economic development is hindered, business operations are difficult, government budgets are reduced, and procurement demand in the commercial market has shrunk significantly.

The epidemic in Shanghai was blocked in April, and the national epidemic prevention and control was lifted in December, resulting in almost all employees working from home or studying online, thus driving the purchasing demand in the consumer market, according to IDC.

At present, the rate of home printers in China is far lower than that of developed countries such as Europe and the United States, and there is huge room for growth in China’s consumer printer market. IDC believes that in the long run, there is still growth potential in consumer printer market demand.

In the fourth quarter, the A3 laser devices market fell by 17.4% year-on-year. On the one hand, some manufacturers adopted more aggressive sales strategies in the third quarter to achieve their growth targets in the first half of the fiscal year, resulting in abnormal channel inventory in the fourth quarter.

On the other hand, due to the impact of the epidemic, the economic development is sluggish, the budgets of government and enterprise users have decreased, and the market size has shrunk.

In addition, the product distribution of laser printers has also changed: first, the market demand for black and white speeds below 25ppm and above 40ppm has shrunk, and the demand for 25-35ppm has been relatively stable; second, the share of colour laser devices has climbed.

As market competition intensifies, manufacturers have shifted from competing for market share to ensuring profit growth. Therefore, starting from the end of 2022, some manufacturers will increase prices to varying degrees, IDC added.

Ren Mengxue, Senior Analyst of IDC China Printing, Imaging and Document Solutions Research Department, said: “2022 will be a turbulent and complicated year, with the consumer market leaping to a new level and the commercial market under pressure. With the unblocking of the epidemic at the end of the year, the market will lose the disturbing factor of “epidemic”.

“2023 will be a new situation for major manufacturers, and it will be a real moment to truly test product quality, after-sales service, and business management.”