China’s overall printer market is expected to decline by 12.5% year-on-year in 2024 and will still face great challenges in 2025.

China’s overall printer market is expected to decline by 12.5% year-on-year in 2024 and will still face great challenges in 2025.

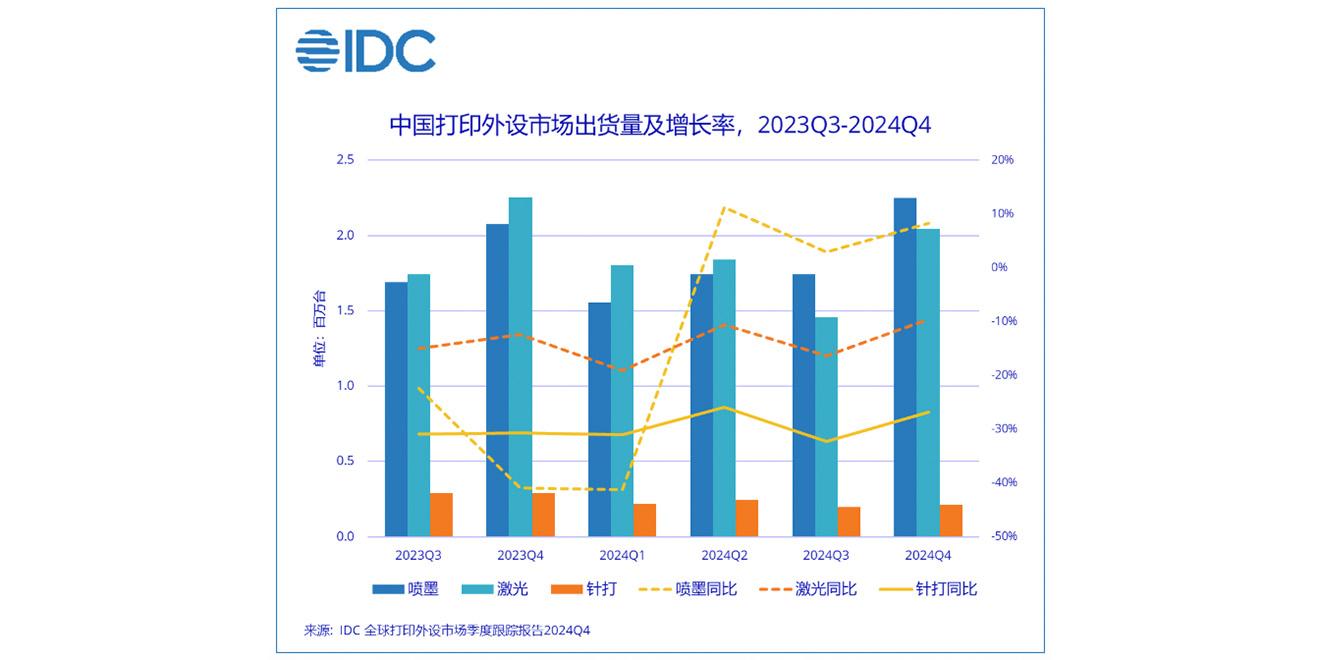

The latest “Global Printing Peripherals Market Quarterly Tracking Report (Q4 2024)” released by International Data Corporation (IDC) shows that the shipment volume of China’s printing peripherals market in 2024 will be 15.308 million units, a year-on-year decrease of 12.5%.

Among them, the shipment volume of inkjet printers was 7.292 million units, a year-on-year decrease of 8.7%; the shipment volume of laser printers was 7.143 million units, a year-on-year decrease of 13.8%; and the shipment volume of dot matrix printers was 874,000 units, a year-on-year decrease of 28.9%.

Affected by factors such as an unstable economic environment, tightening user budgets and consumption downgrades, the printer market has shown negative growth for two consecutive years.

According to IDC, in 2024, the inkjet market shipments exceeded that of lasers, and manufacturers performed relatively rationally. Only in the first quarter did it decline year-on-year due to the high base in 2023Q1. From the second quarter to the fourth quarter, it showed a year-on-year increase trend. Especially in the second half of the year, demand during the start of the school year was higher than expected. The real-time interactivity, intuitive display, and precise influence of the live broadcast platform continued to increase the importance of printers among students. Due to promotions in the fourth quarter and the boost from the national subsidy policy, e-commerce platforms were very active and some models were in short supply. After receiving national subsidies, the prices of online models are very competitive, which has had a significant impact on offline channels.

IDC continued explaining that as prices continue to fall and users have more channels to obtain information, the low-cost advantage of ink tank printers is being praised by more users. The number of people working independently is increasing, and these users tend to buy ink tank printers to balance their family and work needs. The trend of small and medium-sized enterprises switching from laser to inkjet is becoming more and more obvious, and the decline in user printing volume has also contributed to the development of this trend.

Manufacturers have also launched more new ink tank printers to support the needs of different categories of customers. A3 commercial inkjet printers have significant cost advantages in colour printing and have received more attention in the rental market. However, due to the impact of overseas market products, the full-year performance did not meet expectations.

In 2024, A4 format laser printers and MFPs will decline by 12.8% year-on-year. The national subsidy policy for printers will be implemented in the fourth quarter of 2024, affecting the growth of demand in the consumer market in the fourth quarter. The commercial market was more affected by the economic downturn, with demand falling significantly. Especially small and medium-sized enterprises tend to choose inkjet printers under limited costs. Many manufacturers have launched a variety of mid- and low-end A4 laser printers to compete for more market share.

In 2024, A3 format laser printers and MFPs decreased by 23.5% year-on-year, of which A3 black and white laser printers and MFPs decreased by 25.8% year-on-year, and A3 colour laser printers and MFPs decreased by 19.9% ??year-on-year.

As corporate users reduce costs and increase efficiency and limit the amount of colour printing, the speed of migration from black and white to colour in 2024 will be lower than expected, but the long-term trend of migration from black and white to colour remains unchanged.

IDC added that due to budget constraints, users tend to extend the contract period or extend the use cycle of old machines. The continued decline in customer printing volume and the development of the second-hand machine market have also suppressed the demand for purchasing new machines.

Cheng Yana, Senior Analyst at IDC China’s Printing, Imaging and Document Solutions Research Department, believes that the external environment will still face great challenges in 2025, and manufacturers need to be prepared to respond to supply chain risks; internal competition will become more intense, and manufacturers need to deeply analyse national policies, optimize product layout and channel structure, and pay attention to new opportunities that may be brought about by high-tech development.