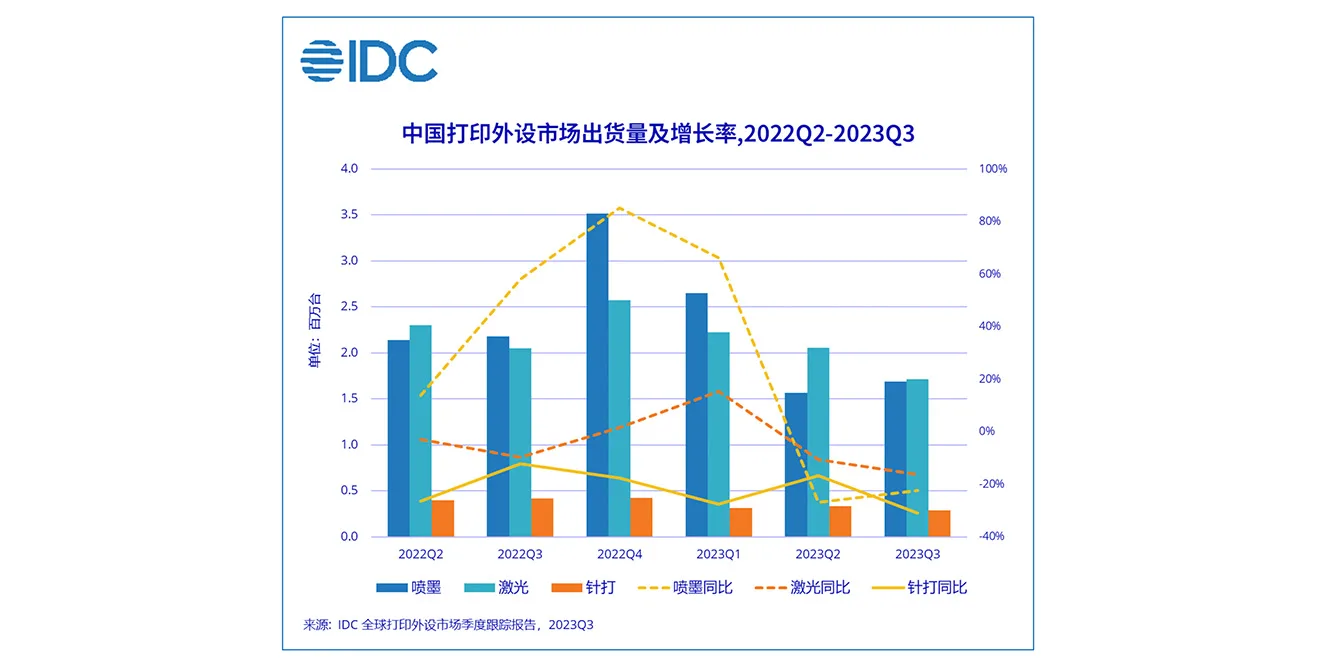

China’s printing peripheral market declined year-on-year across the board in the third quarter, and the market recovery fell short of previous expectations, according to latest research by IDC.

IDC’s latest “Global Printing Peripheral Market Quarterly Tracking Report (Third Quarter of 2023)” shows that in the third quarter of 2023, China’s printing peripheral market shipments were 3.697 million In Taiwan, it fell 20.5% year-on-year and 6.6% month-on-month.

Among them, 1.692 million inkjet printers were shipped, down 22.4% year-on-year; 1.715 million laser printers were shipped, down 16.3% year-on-year; 290,000 dot matrix printers were shipped, down 30.9% year-on-year. The global economic downturn has led to a downgrade in user consumption and an extension of the procurement cycle, resulting in a significant decline in procurement demand.

In the third quarter, due to the promotion of the back-to-school season, the sales of ink cartridge printers increased by 31.4% month-on-month. However, compared with last year, the sales of ink cartridge printers declined year-on-year for two consecutive quarters. Ink cartridge printers are mainly positioned in the consumer market. As the penetration rate of printers in Chinese households increases, printers have gradually become an important learning tool, and low-priced ink cartridge products are still the first choice for many first-time buyers, IDC added.

In the third quarter, due to the promotion of the back-to-school season, the sales of ink cartridge printers increased by 31.4% month-on-month. However, compared with last year, the sales of ink cartridge printers declined year-on-year for two consecutive quarters. Ink cartridge printers are mainly positioned in the consumer market. As the penetration rate of printers in Chinese households increases, printers have gradually become an important learning tool, and low-priced ink cartridge products are still the first choice for many first-time buyers, IDC added.

Ink tank printers declined year-on-year for the first time this year, and the decline was smaller than that of cartridge printers. The proportion of ink tanks is gradually increasing, and the ratio to ink cartridge products is 50:50. The price of entry-level ink tank printers continues to drop. According to IDC, families with middle school and high school students who print a lot or families who need to replace their printers prefer to purchase ink tank printers considering the printing cost.

As small and medium-sized enterprises face pressure to reduce costs, more cost-effective ink tank printers are becoming more popular. And due to the environmental protection advantages of inkjet printers, more ink tank printers have entered the purchasing lists of hospitals and schools, IDC said.

In the third quarter, A4 format laser printers fell by 14.9% year-on-year, of which A4 black and white laser printers fell by 15.4% year-on-year, and A4 colour laser printers fell by 8.3% year-on-year. Price-sensitive customers switched from laser to inkjet, accelerating the decline in laser market demand. Colour printers have a relatively fixed customer base, and the decline is better than black and white. Mainstream manufacturers have alleviated the oversupply market situation by adjusting their shipment pace and increasing T3 channel promotions.

In the third quarter, A3 format laser composite machines fell by 27.4% year-on-year, of which A3 black and white laser composite machines fell by 29.0% year-on-year, and A3 colour laser composite machines fell by 24.2% year-on-year. A3 demand continues to decline, channel inventory turnover levels are generally high, the overall market shrinks further, user consumption downgrades, and demand migrates from medium to high speed to medium to low speed.

Colour machines have a greater profit contribution, and manufacturers have strategically turned to colour machines. The gap between colour machines and black and white machines is narrowing, and the price/performance ratio has improved. Therefore, the decline in demand for colour machines is slightly better than that for black and white machines.

IDC believes that commercial market demand will not be released quickly in the short term, and it is recommended that manufacturers and channels focus on key industries and deeply explore customer needs.

To sum up, Cheng Yana, Senior Analyst of IDC China’s Printing, Imaging and Document Solutions Research Department, believes that the commercial market will be sluggish in 2023 and will also face greater uncertainty in 2024 due to the impact of internal and external environments. Facing a complex and ever-changing market, major manufacturers must be prepared for slow demand recovery. In a turbulent market environment, they must pay more attention to a healthy industry ecology than increasing market share.