Bangladesh’s hardcopy peripherals market records improved performance amidst the 3rd COVID-19 wave and grows by 44.3% YoY in 1Q22, reports IDC.

According to the latest data released by International Data Corporation (IDC), Bangladesh’s hardcopy peripherals (HCP) market registered shipments of 0.06 million units in 1Q22, increasing by 30.9% quarter-over-quarter (QoQ). From a year-over-year (YoY) perspective, the market posted a growth of 44.3% in the Jan-March quarter, according to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker, 1Q 2022 release.

The inkjet segment noted a YoY growth of 41.9%; as educational institutes opened at the end of February after the Bangladesh government had announced the closure of institutes at the beginning of February, the demand for the inkjet segment was created. Also, inkjet saw a significant increase in shipment imports as key players managed to import large shipments in 1Q22 compared to 4Q21 (Oct-Dec). The demand was created from the individual customer segments like personal users and students. In addition, there has been a noted increase in the number of inquiries coming in for inkjet printers from the SOHOs (small offices & home offices) and SMBs. This follows the increasing popularity of inkjet in the past few quarters at the back of their low cost per page offering and good print quality.

The laser segment (including copiers) recorded a YoY growth of 45.8%. The laser copier segment observed a YoY growth of 38.8%. The laser printer segment also observed a YoY growth of 45.9%. The demand for the printer-based laser segment primarily came from large corporates and multinational companies. Also, the popularity of the laser-based printer models increased in 1Q22 owing to good quality output.

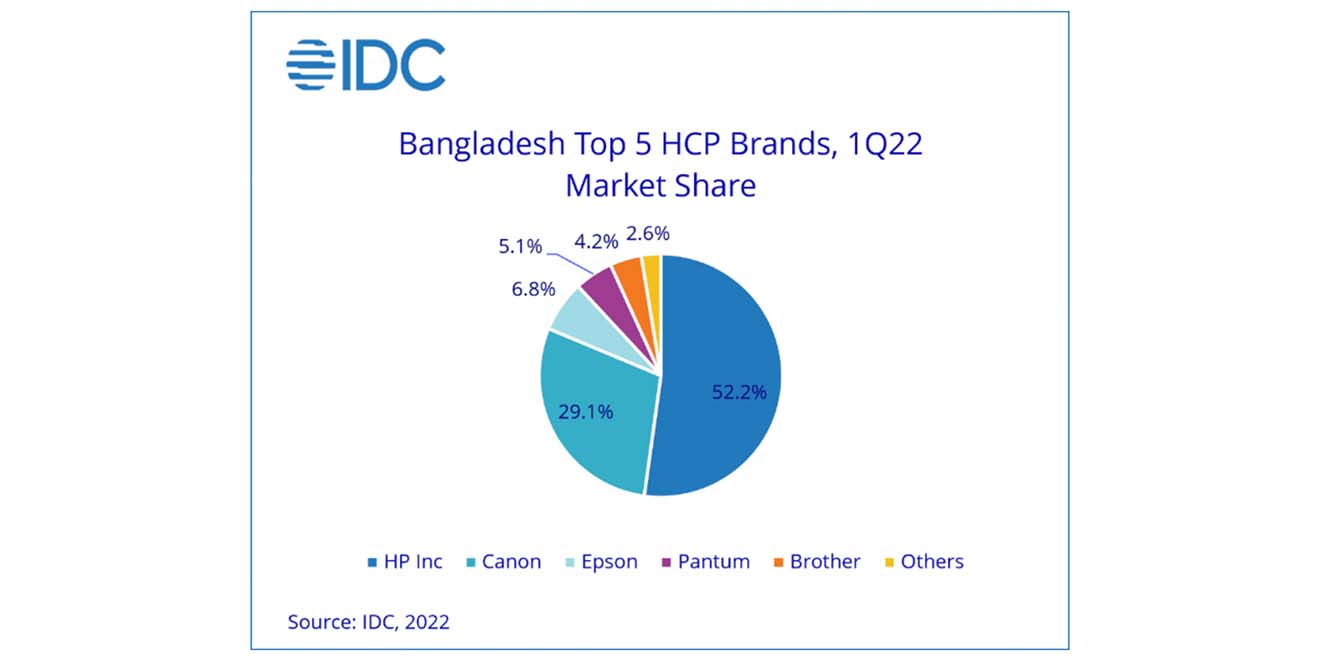

“With ~80% market share, HP and Canon are dominating the Bangladesh HCP Market in 1Q22. In Bangladesh, consumer preference is more inclined towards popular brands like HP, Canon, and Epson. Also, government bodies are the primary purchasers of these brands. At 52.2% market share in 1Q22, HP recorded its highest market share till-date. HP had spill over shipments in 1Q22 from 4Q21, both in the inkjet and laser segments. Within the laser segment, Pantum has picked 3rd position in the Bangladesh market for 1Q22 and is growing gradually. Over the quarters, multi-function printers (MFPs) have become a popular product category among its users. Bangladesh government’s initiative of making Bangladesh a digital economy is also fuelling the MFP market,” said Apoorv Kandharkar, Market Analyst, IPDS, IDC India.

Top 3 brand highlights:

HP Inc. (excluding Samsung) continued to maintain its leadership in the overall Bangladesh HCP market with a share of 52.2% and a YoY growth in shipment of 92.1%. The growth was led by the laser printer segment, wherein HP grew by 90.0% YoY yet maintained a market share of 65.5%. The exponential growth follows the acute supply shortage HP faced in 2021Q1. In the Inkjet segment, HP grew by 96.4% YoY.

Canon recorded a YoY growth of 9.1% and occupied 2nd position in the overall Bangladesh HCP market, capturing a market share of 29.1%. In the inkjet segment, Canon observed a YoY growth of 75.4% at the back of its Ink tank segment, even though it struggled with the shortage of certain Ink cartridge models. In the laser segment (including laser copiers), Canon maintained its 2nd position with a market share of 20.5%.

Epson occupied the 3rd position in the overall Bangladesh HCP market with a market share of 6.8% while registering a YoY growth of 6.1%. In the inkjet segment, it maintained 3rd position in the market with a share of 16.0% and a YoY growth of 9.6%.

“Consumer sentiments are expected to remain buoyant in 2022. However, with the continued issues from the vendors’ end due to chip shortages and an increase in logistics costs, the supply of HCP devices will be impacted. This will lead to the trickling of 2Q22’s unmet demand into the later quarters. Business sentiments, on the other hand, are expected to be slightly dampened as the pace of economic recovery is slower than the one perceived earlier. From a year-on-year perspective, the printer market for Bangladesh is expected to have double-digit growth in CY2022,” said Bani Johri, Senior Market Analyst, IPDS, IDC India.