Asia/Pacific (excluding Japan) Hardcopy Peripherals (HCP) market faces sharp declines amid economic and political volatility in 2024H1; laser A3 and A4 segments hit hard, while inkjet shows resilience in selected regions.

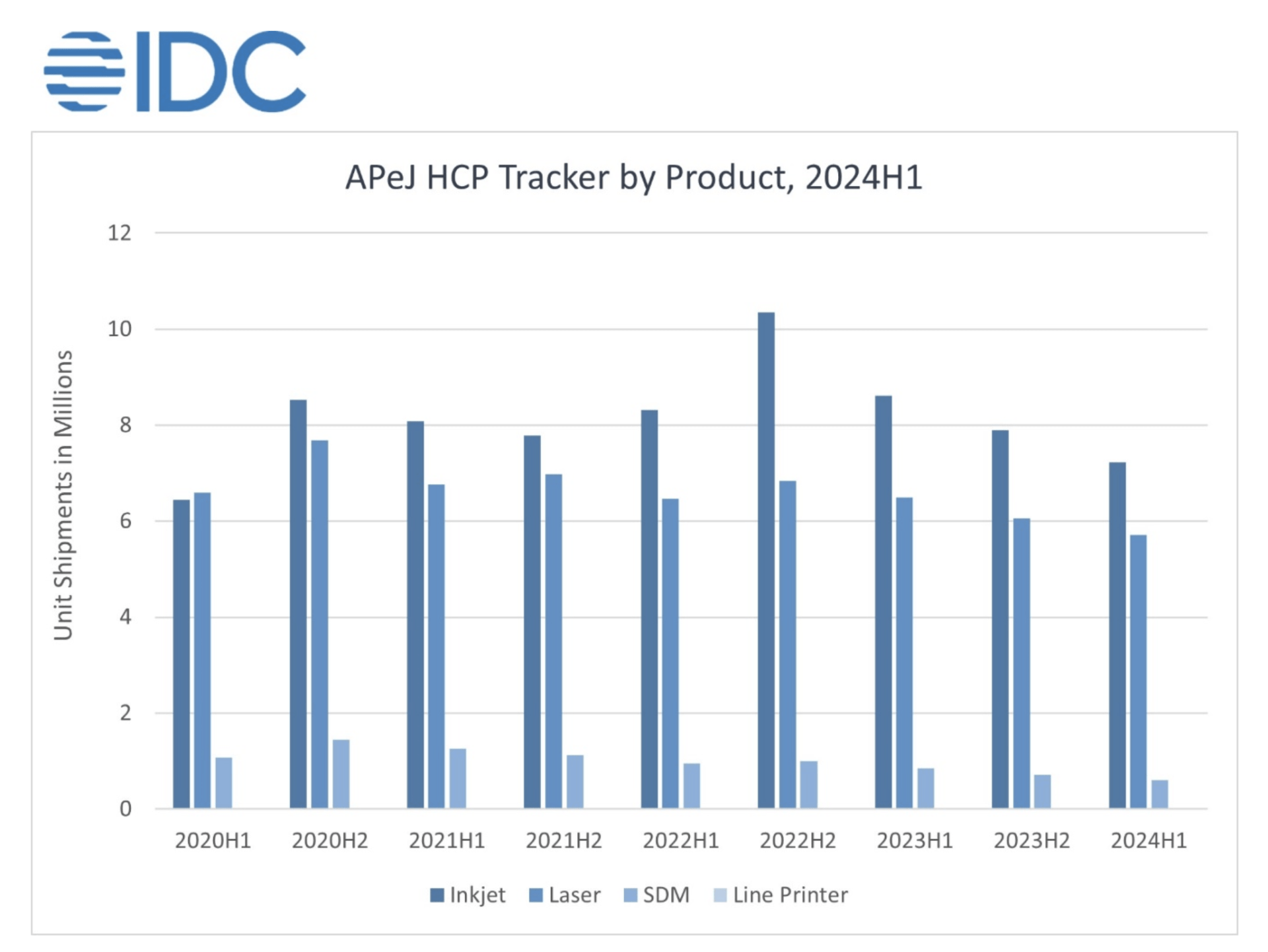

According to the IDC Worldwide Hardcopy Peripherals Tracker, Asia/Pacific excluding Japan region (APeJ) recorded a year-over-year (YoY) semi-annual decline of 15.2% in 2024H1 compared to 2023H1. From January to June of 2024, IDC recorded that the total HCP shipments reached 13.5 million units across the region. In terms of sequential semi-annual performance, 2024H1 dropped by 7.8% compared to 2023H2.

Breaking down the semi-annual performance of 2024H1 against 2023H1 by each product type:

- Inkjet printers declined by 16.1%;

- Laser devices (including A4 and A3 machines) dropped by 12.1%; and

- Serial Dot Matrix (SDM) segment declined by 29.4%.

The total inkjet market showed a much steeper decline as compared to what IDC anticipated. The current state of the economy in multiple countries played a major toll on consumer spending. End users were actively reducing their spending and were more cautious with their purchasing behaviour due to high inflation and the rising cost of living.

The majority of APeJ countries showed a drop in shipments for ink cartridge models contributed by the tightening of household spending. IDC observed that pricing for both ink cartridge and ink tank printers are getting competitive across brands in order to gain comparative advantage in such a competitive environment.

The majority of APeJ countries showed a drop in shipments for ink cartridge models contributed by the tightening of household spending. IDC observed that pricing for both ink cartridge and ink tank printers are getting competitive across brands in order to gain comparative advantage in such a competitive environment.

The new year started with weak business sentiments as SMBs were seen to tighten their spending, and businesses continued to downsize and took cost-cutting measures. Based on IDC’s prior forecast assumptions, the post-election dynamics did turn out to have a negative impact on the laser A3 market in several countries like India, Indonesia, Korea, and Taiwan.

The total laser A3 segment declined by 17.5% due to the political volatility which caused businesses to hold their spending and government put on hold their projects and tenders until the situation became more stable. As for the laser A4 segment, the market recorded an 11.5% drop. Entry-level laser A4 segment continued to lose its market share to ink tank products as inkjet continued to grow its presence in the market.

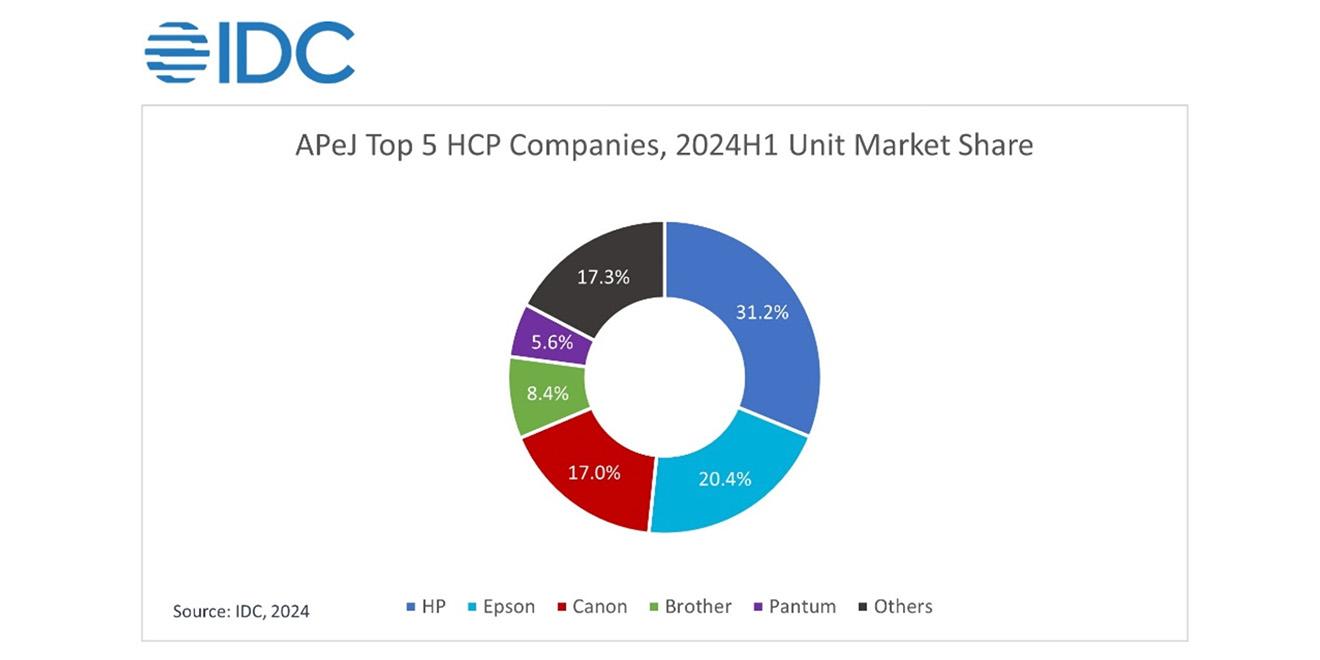

Top three home/office printer brand highlights for the Asia/ Pacific region:

- HP secured the top spot in the total HCP market. However, HP’s total shipments for both inkjet and laser declined by 13.5% in 2024H1, which provided a clear indication that both consumer and commercial demand had softened. Most vendors were faced with similar issues, as the current state of the economy had a huge impact on driving down demand.

- Epson continued to dominate the inkjet market with approximately 2.5 million shipments across the region. Epson’s inkjet shipments declined by 9.8% YoY. The migration rate from laser A4 to ink tank had slowed down in several matured countries but still showed signs of opportunity in a few developing countries.

- Canon remained in third position this quarter, with a YoY decline of 21.8%. Canon’s inkjet portion declined by 29.4% YoY, but its laser segment grew by 6.4% compared to the same period of last year. This growth was largely due to strong shipments of mono printer-based devices, driven by corporate and government deals in multiple countries, similar to the previous quarter.

“In reality, the rate of decline for the total HCP market surpassed our expectation for 2024H1. Other than the impact of macroeconomic factors, political factors played a huge role in suppressing demand . Just a few weeks into the second half of 2024, there had already been political turmoil happening in a few countries. Thus, such factors will produce a negative outcome for the coming quarters.” said Yi Karl Tai, Research Analyst at IDC Asia Pacific.

ASEAN HCP market dipped 6.4% YoY in 2Q24, recovery expected in 2H24

The HCP market in the ASEAN subregion shipped 1.24 million units in the second quarter of 2024 (2Q24), 6.4% lower than the 1.32 million units shipped in the same period last year (2Q23), according to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker.![]()

Compared to 2Q23, inkjet declined by 2.4% YoY, which indicated an improvement over the previous quarter, which saw a 20.2% annual decline. Laser devices, on the other hand, declined by 13.6% YoY, showing little improvement from 1Q24 with a 16.7% annual decline. This declining trend was also seen in the Serial Dot Matrix (SDM) printers, which declined by 44.3% YoY.

Ink cartridge machines continue to decelerate in 2024 due to the strong appreciation of consumers and MSMEs for ink tank machines in Indonesia and Malaysia. Conversely, the Philippines still sees room for growth for ink cartridge machines due to back-to-school and home printing, and opportunities from first-time users. In Thailand and Singapore, users look for more cost-effective and long-term decisions when purchasing technology products and opt to buy ink tank printers rather than cartridge models.

In 2024 Q2, both laser A4 and A3 markets declined significantly, with the A3 market declining by 8.2% and the A4 market declining by 14.1%. This current market situation is due to slower demand from the commercial market, as government tender fulfilments, businesses, and corporations primarily drive copiers and laser printers.

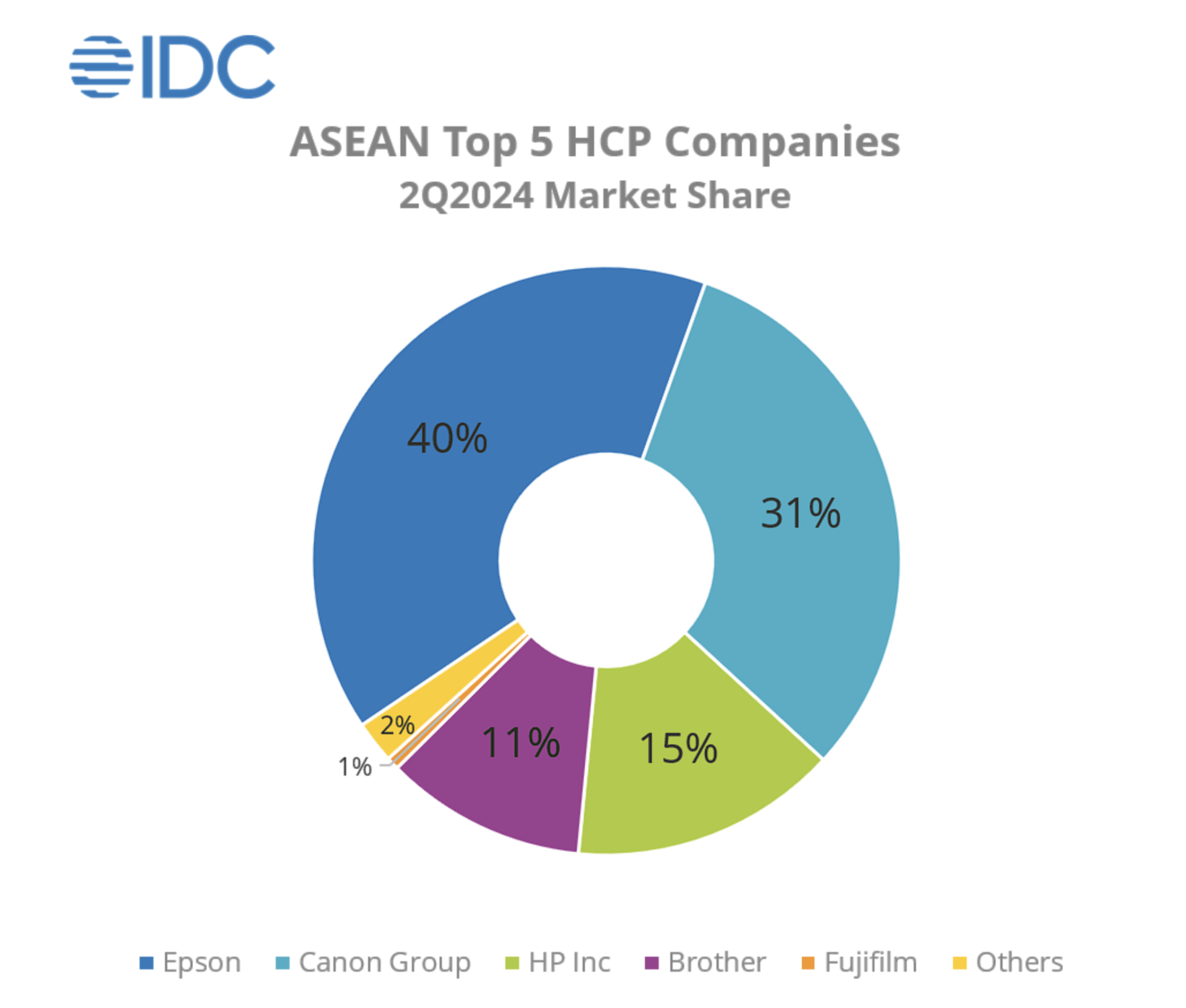

Top three home/office printer brand highlights for the ASEAN region:

- Epson has maintained its status as the leader of ASEAN’s ink tank market, but as overall inkjet demand decreased, the leading ink tank brand was also heavily impacted. With a lower shipment in their strongest markets, namely Indonesia and the Philippines, the total annual shipment for 2024 is poised for a decline.

- While Canon managed to maintain its overall share in Thailand and their position in Indonesia, Malaysia and the Philippines throughout 2023, inkjet shipments in 2024 are yet to show signs of recovery for Canon. Canon’s laser products are also slowing down in Indonesia and Vietnam, which had historically been very important markets for the brand, thanks to closer ties with government accounts.

- HP: After securing a higher share in the ink tank market in key countries like Indonesia, Malaysia, and the Philippines with their Smart Tank series, HP’s shipment slowed down significantly in the first half of 2024. Bearing high stocks amidst an uncertain business climate proved challenging for HP in navigating 2024.

“As the overall region saw higher stock in key markets, IDC anticipates a softened recovery towards the latter half of 2024. Home and SMB users continue to drive the adoption of ink tanks, which have been followed in commercial markets too,” said Leonard Adiarto Sudjono, Senior Research Analyst at IDC Asia Pacific.

“As the overall region saw higher stock in key markets, IDC anticipates a softened recovery towards the latter half of 2024. Home and SMB users continue to drive the adoption of ink tanks, which have been followed in commercial markets too,” said Leonard Adiarto Sudjono, Senior Research Analyst at IDC Asia Pacific.

On the laser side, short-term improvement is expected due to increased government spending in ASEAN and a positive outlook from the commercial sector in the next year. However, in the long term, IDC maintains its sentiment for laser machines’ decline in ASEAN.

“A3 laser is still going to continue declining as end users move toward long-term investment with higher-end machines in smaller fleets while A4 laser users are expected to transition to inkjet machines as well as A3 MFPs”, said Yel Bautista, Research Analyst at IDC Asia Pacific.