New rules will level the playing field for EU remanufacturers as non-EU sellers take on VAT liability.

New rules will level the playing field for EU remanufacturers as non-EU sellers take on VAT liability.

The European Council has formally adopted new VAT rules to close tax loopholes and improve compliance on goods sold to EU consumers. The changes, which take effect from 1 July 2028, could reshape pricing dynamics across the office imaging sector.

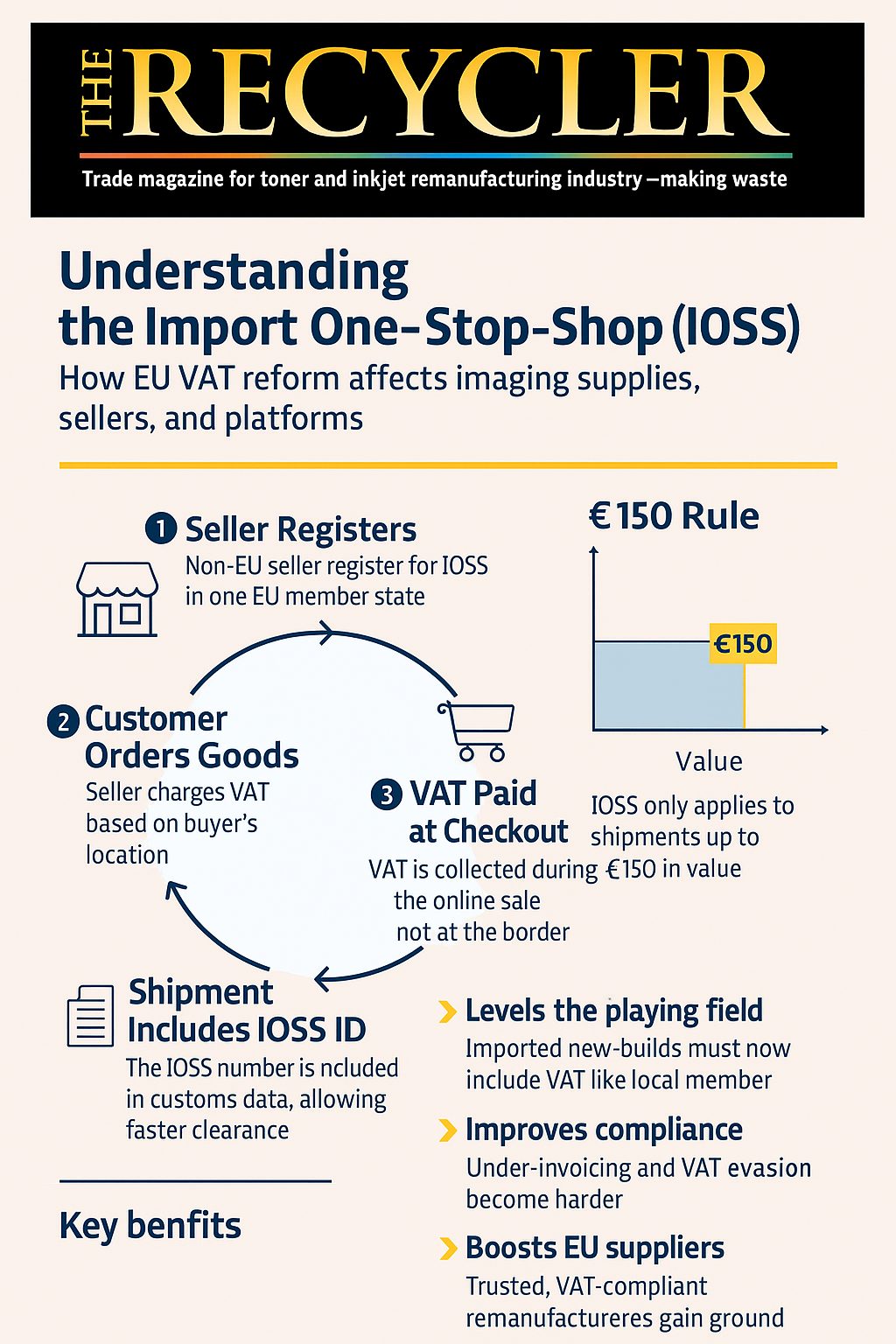

The new directive shifts VAT liability from the EU buyer to the non-EU seller or platform, who must now collect and remit VAT at the point of sale. This replaces the current model where VAT is often collected at the border, causing delays and confusion.

The goal is to encourage the use of the Import One-Stop-Shop (IOSS). The IOSS allows non-EU suppliers to register for VAT in one EU country and declare all cross-border sales through a single monthly return. Sellers not using the IOSS must register separately in every country where they sell — a costly and complex process.

VAT closes the gap

The rules apply to all distance sales of imported goods under €150. Platforms such as Amazon, eBay, and specialist B2B portals will be responsible for collecting VAT when they are the ‘deemed seller’. This is expected to result in tighter controls and fewer non-compliant listings.

For the imaging sector, the impact is significant. Grey-market products have long undercut EU remanufacturers by avoiding VAT.

“Imported cartridges will now need to include VAT just like locally remanufactured ones,” one industry source told The Recycler. “That could add 20% to the cost of some grey imports overnight.”

EU-based remanufacturers, already VAT-compliant, are expected to benefit. The price gap that previously favoured VAT-free imports will narrow, making remanufactured products more competitive — not only on quality and sustainability, but on price.

“These changes reward those playing by the rules,” a remanufacturer commented. “The free ride for non-compliant sellers is getting harder.”

Enforcement and compliance

The IOSS simplifies VAT reporting but raises the bar for compliance. Sellers must charge the correct VAT rate for each destination country, collect it at checkout, and pay it upfront.

This reduces the risk of customs fraud or under-declared values — long-standing issues in the cartridge trade. It also speeds up delivery by avoiding VAT charges at the border.

Sellers who fail to comply may face platform bans or fines. For smaller or low-margin overseas traders, the cost of compliance may force them out of the EU market altogether.

Advantage: Europe

The directive gives a clear advantage to EU-based remanufacturers and authorised distributors who are already VAT registered and compliant. It also supports public sector buyers looking for traceable, compliant, and sustainable supply chains.

The changes amend the existing VAT Directive 2006/112/EC and will enter into force 20 days after publication in the Official Journal of the EU. Businesses have just under three years to prepare.

The imaging sector — long exposed to unfair competition from VAT-dodging imports — may now see a more balanced market.